Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter. Trends reversed 180 degrees during the first quarter amid Powell’s pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the first quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards OneSpan Inc. (NASDAQ:OSPN).

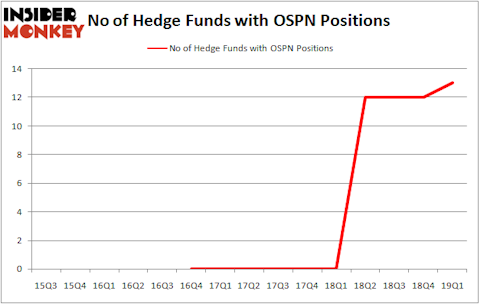

OneSpan Inc. (NASDAQ:OSPN) investors should be aware of an increase in hedge fund interest of late. Our calculations also showed that OSPN isn’t among the 30 most popular stocks among hedge funds.

Today there are a large number of methods shareholders can use to value publicly traded companies. Two of the less utilized methods are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the elite money managers can outperform the market by a solid amount (see the details here).

We’re going to go over the key hedge fund action regarding OneSpan Inc. (NASDAQ:OSPN).

What have hedge funds been doing with OneSpan Inc. (NASDAQ:OSPN)?

At Q1’s end, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the previous quarter. By comparison, 0 hedge funds held shares or bullish call options in OSPN a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

More specifically, Legion Partners Asset Management was the largest shareholder of OneSpan Inc. (NASDAQ:OSPN), with a stake worth $40.2 million reported as of the end of March. Trailing Legion Partners Asset Management was Ancora Advisors, which amassed a stake valued at $9.1 million. D E Shaw, Archon Capital Management, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Now, key hedge funds have jumped into OneSpan Inc. (NASDAQ:OSPN) headfirst. Prescott Group Capital Management, managed by Phil Frohlich, initiated the biggest position in OneSpan Inc. (NASDAQ:OSPN). Prescott Group Capital Management had $0.4 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $0.4 million position during the quarter. The other funds with new positions in the stock are Ken Griffin’s Citadel Investment Group and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s check out hedge fund activity in other stocks similar to OneSpan Inc. (NASDAQ:OSPN). These stocks are Intellia Therapeutics, Inc. (NASDAQ:NTLA), Federal Agricultural Mortgage Corp. (NYSE:AGM), NCI Building Systems, Inc. (NYSE:NCS), and Carolina Financial Corporation (NASDAQ:CARO). This group of stocks’ market caps are similar to OSPN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NTLA | 10 | 16843 | 0 |

| AGM | 9 | 26105 | 0 |

| NCS | 17 | 65728 | -3 |

| CARO | 7 | 47137 | -1 |

| Average | 10.75 | 38953 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $39 million. That figure was $71 million in OSPN’s case. NCI Building Systems, Inc. (NYSE:NCS) is the most popular stock in this table. On the other hand Carolina Financial Corporation (NASDAQ:CARO) is the least popular one with only 7 bullish hedge fund positions. OneSpan Inc. (NASDAQ:OSPN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately OSPN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on OSPN were disappointed as the stock returned -24.5% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.