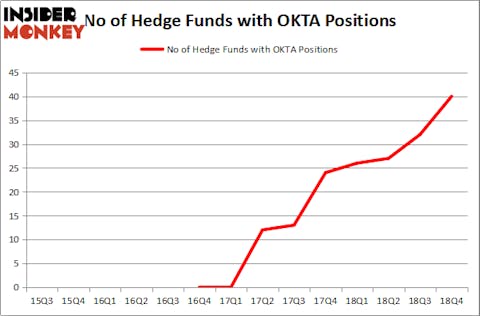

Is Okta, Inc. (NASDAQ:OKTA) a good stock to buy? Money managers are buying. The number of long hedge fund positions jumped by 8 during the fourth quarter of 2018. There were 32 hedge funds in our database with OKTA positions at the end of September. Overall hedge fund sentiment towards OKTA is at its all time high. This is usually a bullish sign. For example hedge fund sentiment in Xilinx Inc. (XLNX) was also at its all time high at the beginning of this year and the stock returned more than 46% in 2.5 months. We observed similar performances from Twilio, MSCI and Progressive Corporation (PGR); these stocks returned 37%, 29% and 27% respectively. Hedge fund sentiment towards IQVIA Holdings Inc. (IQV), Brookfield Asset Management Inc. (BAM), Atlassian Corporation Plc (TEAM), RCL, MTB, VAR and CRH hit all time highs at the end of December, and all of these stocks returned more than 20% in the first 2.5 months of this year.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a look at the new hedge fund action encompassing Okta, Inc. (NASDAQ:OKTA).

How have hedgies been trading Okta, Inc. (NASDAQ:OKTA)?

At the end of the fourth quarter, a total of 40 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from the previous quarter. By comparison, 26 hedge funds held shares or bullish call options in OKTA a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Okta, Inc. (NASDAQ:OKTA) was held by Alkeon Capital Management, which reported holding $124.4 million worth of stock at the end of September. It was followed by Whale Rock Capital Management with a $119.5 million position. Other investors bullish on the company included Renaissance Technologies, Two Sigma Advisors, and D E Shaw.

As one would reasonably expect, some big names have jumped into Okta, Inc. (NASDAQ:OKTA) headfirst. Light Street Capital, managed by Glen Kacher, assembled the most outsized position in Okta, Inc. (NASDAQ:OKTA). Light Street Capital had $40.8 million invested in the company at the end of the quarter. Stanley Druckenmiller’s Duquesne Capital also initiated a $11.1 million position during the quarter. The other funds with new positions in the stock are Nehal Chopra’s Ratan Capital Group, James Crichton’s Hitchwood Capital Management, and Philip Hempleman’s Ardsley Partners.

Let’s also examine hedge fund activity in other stocks similar to Okta, Inc. (NASDAQ:OKTA). These stocks are Ubiquiti Networks Inc (NASDAQ:UBNT), PVH Corp (NYSE:PVH), Western Gas Partners, LP (NYSE:WES), and ICON Public Limited Company (NASDAQ:ICLR). All of these stocks’ market caps are closest to OKTA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UBNT | 19 | 387799 | 3 |

| PVH | 35 | 814656 | -9 |

| WES | 6 | 53279 | -2 |

| ICLR | 23 | 461592 | 1 |

| Average | 20.75 | 429332 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $429 million. That figure was $673 million in OKTA’s case. PVH Corp (NYSE:PVH) is the most popular stock in this table. On the other hand Western Gas Partners, LP (NYSE:WES) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Okta, Inc. (NASDAQ:OKTA) is more popular among hedge funds. Hedge funds have never been bullish on OKTA and they were rewarded for their confidence in the stock. OKTA shares returned 37.4% and performed even better than the top 15 most popular stocks among hedge funds which returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. OKTA shareholders beat the market by more than 20 percentage points. You can see the entire list of these shrewd hedge funds who are betting on OKTA here. Their other stock picks might be worth checking out.

Disclosure: None. This article was originally published at Insider Monkey.