In this article you are going to find out whether hedge funds think Novavax, Inc. (NASDAQ:NVAX) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

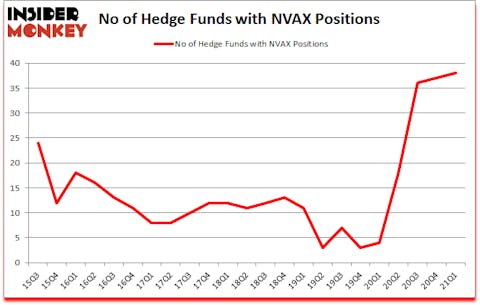

Novavax, Inc. (NASDAQ:NVAX) has experienced an increase in support from the world’s most elite money managers lately. Novavax, Inc. (NASDAQ:NVAX) was in 38 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic was previously 37. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that NVAX isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

According to most traders, hedge funds are assumed to be worthless, outdated financial vehicles of the past. While there are over 8000 funds with their doors open at present, Our researchers hone in on the leaders of this group, around 850 funds. Most estimates calculate that this group of people control most of the smart money’s total capital, and by keeping track of their finest equity investments, Insider Monkey has deciphered various investment strategies that have historically outperformed the market. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we’re going to take a look at the recent hedge fund action surrounding Novavax, Inc. (NASDAQ:NVAX).

Do Hedge Funds Think NVAX Is A Good Stock To Buy Now?

At first quarter’s end, a total of 38 of the hedge funds tracked by Insider Monkey were long this stock, a change of 3% from one quarter earlier. By comparison, 4 hedge funds held shares or bullish call options in NVAX a year ago. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Among these funds, RA Capital Management held the most valuable stake in Novavax, Inc. (NASDAQ:NVAX), which was worth $544.3 million at the end of the fourth quarter. On the second spot was Citadel Investment Group which amassed $133.4 million worth of shares. Renaissance Technologies, Rock Springs Capital Management, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position RA Capital Management allocated the biggest weight to Novavax, Inc. (NASDAQ:NVAX), around 8.21% of its 13F portfolio. Discovery Capital Management is also relatively very bullish on the stock, designating 7.86 percent of its 13F equity portfolio to NVAX.

With a general bullishness amongst the heavyweights, key money managers have been driving this bullishness. Renaissance Technologies, created the most outsized position in Novavax, Inc. (NASDAQ:NVAX). Renaissance Technologies had $122 million invested in the company at the end of the quarter. Bihua Chen’s Cormorant Asset Management also made a $45.3 million investment in the stock during the quarter. The other funds with new positions in the stock are Srini Akkaraju and Michael Dybbs’s Samsara BioCapital, OrbiMed Advisors, and Brian Ashford-Russell and Tim Woolley’s Polar Capital.

Let’s check out hedge fund activity in other stocks similar to Novavax, Inc. (NASDAQ:NVAX). We will take a look at W.R. Berkley Corporation (NYSE:WRB), Telefonica Brasil SA (NYSE:VIV), Diamondback Energy Inc (NASDAQ:FANG), GameStop Corp. (NYSE:GME), Fortune Brands Home & Security Inc (NYSE:FBHS), PPD, Inc. (NASDAQ:PPD), and Hasbro, Inc. (NASDAQ:HAS). All of these stocks’ market caps match NVAX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WRB | 32 | 644589 | -5 |

| VIV | 9 | 90185 | 1 |

| FANG | 35 | 343531 | 1 |

| GME | 13 | 96439 | -14 |

| FBHS | 23 | 434532 | -7 |

| PPD | 29 | 822954 | 0 |

| HAS | 31 | 277091 | -5 |

| Average | 24.6 | 387046 | -4.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.6 hedge funds with bullish positions and the average amount invested in these stocks was $387 million. That figure was $1271 million in NVAX’s case. Diamondback Energy Inc (NASDAQ:FANG) is the most popular stock in this table. On the other hand Telefonica Brasil SA (NYSE:VIV) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Novavax, Inc. (NASDAQ:NVAX) is more popular among hedge funds. Our overall hedge fund sentiment score for NVAX is 86. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 19.3% in 2021 through June 25th and still beat the market by 4.8 percentage points. Unfortunately NVAX wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on NVAX were disappointed as the stock returned 4.7% since the end of the first quarter (through 6/25) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Novavax Inc (NASDAQ:NVAX)

Follow Novavax Inc (NASDAQ:NVAX)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 10 Best Growth Stocks to Buy and Hold for Several Years

- Bruce Kovner’s Trading Strategy and Top 10 Picks

Disclosure: None. This article was originally published at Insider Monkey.