Does NIO Inc. (NYSE:NIO) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

NIO Inc. (NYSE:NIO) investors should pay attention to an increase in activity from the world’s largest hedge funds of late. Our calculations also showed that nio isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are assumed to be underperforming, outdated investment tools of years past. While there are over 8000 funds with their doors open today, Our researchers look at the top tier of this group, approximately 750 funds. These hedge fund managers oversee the lion’s share of the hedge fund industry’s total capital, and by keeping an eye on their top stock picks, Insider Monkey has figured out a number of investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to view the latest hedge fund action encompassing NIO Inc. (NYSE:NIO).

Hedge fund activity in NIO Inc. (NYSE:NIO)

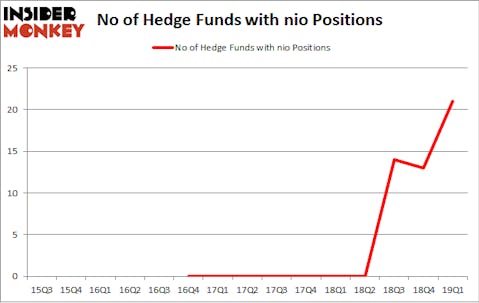

Heading into the second quarter of 2019, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 62% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards NIO over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Hillhouse Capital Management held the most valuable stake in NIO Inc. (NYSE:NIO), which was worth $108.7 million at the end of the first quarter. On the second spot was Segantii Capital which amassed $21.4 million worth of shares. Moreover, D E Shaw, Serenity Capital, and Arrowgrass Capital Partners were also bullish on NIO Inc. (NYSE:NIO), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, specific money managers have jumped into NIO Inc. (NYSE:NIO) headfirst. Hillhouse Capital Management, managed by Lei Zhang, established the most outsized position in NIO Inc. (NYSE:NIO). Hillhouse Capital Management had $108.7 million invested in the company at the end of the quarter. Simon Sadler’s Segantii Capital also made a $21.4 million investment in the stock during the quarter. The other funds with brand new NIO positions are D. E. Shaw’s D E Shaw, Wang Chan’s Serenity Capital, and Nick Niell’s Arrowgrass Capital Partners.

Let’s go over hedge fund activity in other stocks similar to NIO Inc. (NYSE:NIO). These stocks are Buckeye Partners, L.P. (NYSE:BPL), Alcoa Corporation (NYSE:AA), W.R. Grace & Co. (NYSE:GRA), and Flex Ltd. (NASDAQ:FLEX). This group of stocks’ market caps match NIO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BPL | 5 | 12374 | 0 |

| AA | 34 | 527362 | 4 |

| GRA | 36 | 1771591 | -1 |

| FLEX | 27 | 884594 | 3 |

| Average | 25.5 | 798980 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $799 million. That figure was $216 million in NIO’s case. W.R. Grace & Co. (NYSE:GRA) is the most popular stock in this table. On the other hand Buckeye Partners, L.P. (NYSE:BPL) is the least popular one with only 5 bullish hedge fund positions. NIO Inc. (NYSE:NIO) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately NIO wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); NIO investors were disappointed as the stock returned -36.5% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.