The market has been volatile in the last few months as the Federal Reserve finalized its rate cuts and uncertainty looms over trade negotiations with China. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points over the last 12 months. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, though some funds increased their exposure dramatically at the end of Q3 and the beginning of Q4. In this article, we analyze what the smart money thinks of New York Community Bancorp, Inc. (NYSE:NYCB) and find out how it is affected by hedge funds’ moves.

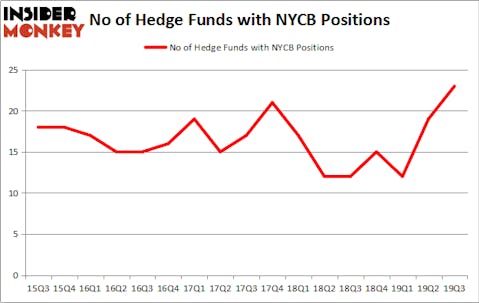

New York Community Bancorp, Inc. (NYSE:NYCB) investors should be aware of an increase in support from the world’s most elite money managers lately. NYCB was in 23 hedge funds’ portfolios at the end of September. There were 19 hedge funds in our database with NYCB holdings at the end of the previous quarter. Our calculations also showed that NYCB isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are many metrics shareholders can use to size up their stock investments. A duo of the most underrated metrics are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the best investment managers can trounce the market by a healthy margin (see the details here).

Noam Gottesman of GLG Partners

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a look at the recent hedge fund action encompassing New York Community Bancorp, Inc. (NYSE:NYCB).

Hedge fund activity in New York Community Bancorp, Inc. (NYSE:NYCB)

At Q3’s end, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 21% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards NYCB over the last 17 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Kahn Brothers was the largest shareholder of New York Community Bancorp, Inc. (NYSE:NYCB), with a stake worth $69.5 million reported as of the end of September. Trailing Kahn Brothers was Arrowstreet Capital, which amassed a stake valued at $52.7 million. Renaissance Technologies, Citadel Investment Group, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Kahn Brothers allocated the biggest weight to New York Community Bancorp, Inc. (NYSE:NYCB), around 8.72% of its 13F portfolio. Neo Ivy Capital is also relatively very bullish on the stock, setting aside 0.13 percent of its 13F equity portfolio to NYCB.

As one would reasonably expect, some big names have jumped into New York Community Bancorp, Inc. (NYSE:NYCB) headfirst. Balyasny Asset Management, managed by Dmitry Balyasny, initiated the most outsized position in New York Community Bancorp, Inc. (NYSE:NYCB). Balyasny Asset Management had $7.3 million invested in the company at the end of the quarter. Richard Driehaus’s Driehaus Capital also initiated a $2 million position during the quarter. The other funds with new positions in the stock are Noam Gottesman’s GLG Partners, Matthew Tewksbury’s Stevens Capital Management, and Michael Gelband’s ExodusPoint Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as New York Community Bancorp, Inc. (NYSE:NYCB) but similarly valued. We will take a look at Skechers USA Inc (NYSE:SKX), TCF Financial Corporation (NASDAQ:TCF), GDS Holdings Limited (NASDAQ:GDS), and Sonoco Products Company (NYSE:SON). This group of stocks’ market caps are similar to NYCB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SKX | 26 | 520591 | 3 |

| TCF | 28 | 359418 | 8 |

| GDS | 30 | 1126926 | 2 |

| SON | 20 | 117152 | 1 |

| Average | 26 | 531022 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $531 million. That figure was $298 million in NYCB’s case. GDS Holdings Limited (NASDAQ:GDS) is the most popular stock in this table. On the other hand Sonoco Products Company (NYSE:SON) is the least popular one with only 20 bullish hedge fund positions. New York Community Bancorp, Inc. (NYSE:NYCB) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately NYCB wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); NYCB investors were disappointed as the stock returned -3.7% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.