“The global economic environment is very favorable for investors. Economies are generally strong, but not too strong. Employment levels are among the strongest for many decades. Interest rates are paused at very low levels, and the risk of significant increases in the medium term seems low. Financing for transactions is freely available to good borrowers, but not in major excess. Covenants are lighter than they were five years ago, but the extreme excesses seen in the past do not seem prevalent yet today. Despite this apparent ‘goldilocks’ market environment, we continue to worry about a world where politics are polarized almost everywhere, interest rates are low globally, and equity valuations are at their peak,” are the words of Brookfield Asset Management. Brookfield was right about politics as stocks experienced their second worst May since the 1960s due to escalation of trade disputes. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards Napco Security Technologies Inc (NASDAQ:NSSC) and see how it was affected.

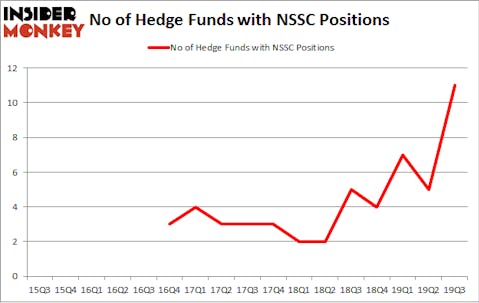

Is Napco Security Technologies Inc (NASDAQ:NSSC) worth your attention right now? Investors who are in the know are in an optimistic mood. The number of long hedge fund positions advanced by 6 recently. Our calculations also showed that NSSC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). NSSC was in 11 hedge funds’ portfolios at the end of the third quarter of 2019. There were 5 hedge funds in our database with NSSC positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

David Harding of Winton Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s analyze the fresh hedge fund action surrounding Napco Security Technologies Inc (NASDAQ:NSSC).

Hedge fund activity in Napco Security Technologies Inc (NASDAQ:NSSC)

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of 120% from the second quarter of 2019. By comparison, 5 hedge funds held shares or bullish call options in NSSC a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Principal Global Investors’s Columbus Circle Investors has the most valuable position in Napco Security Technologies Inc (NASDAQ:NSSC), worth close to $7.9 million, corresponding to 0.3% of its total 13F portfolio. On Columbus Circle Investors’s heels is G2 Investment Partners Management, managed by Josh Goldberg, which holds a $6.1 million position; the fund has 1.7% of its 13F portfolio invested in the stock. Some other peers that are bullish contain Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Mark Broach’s Manatuck Hill Partners and David Harding’s Winton Capital Management. In terms of the portfolio weights assigned to each position G2 Investment Partners Management allocated the biggest weight to Napco Security Technologies Inc (NASDAQ:NSSC), around 1.72% of its 13F portfolio. Manatuck Hill Partners is also relatively very bullish on the stock, earmarking 0.7 percent of its 13F equity portfolio to NSSC.

As industrywide interest jumped, some big names were leading the bulls’ herd. Columbus Circle Investors, managed by Principal Global Investors, created the biggest position in Napco Security Technologies Inc (NASDAQ:NSSC). Columbus Circle Investors had $7.9 million invested in the company at the end of the quarter. Josh Goldberg’s G2 Investment Partners Management also made a $6.1 million investment in the stock during the quarter. The other funds with brand new NSSC positions are David Harding’s Winton Capital Management, Ken Griffin’s Citadel Investment Group, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Napco Security Technologies Inc (NASDAQ:NSSC) but similarly valued. These stocks are Waterstone Financial, Inc. (NASDAQ:WSBF), American Software, Inc. (NASDAQ:AMSWA), Mistras Group, Inc. (NYSE:MG), and Hometrust Bancshares Inc (NASDAQ:HTBI). This group of stocks’ market values are similar to NSSC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WSBF | 17 | 79862 | 2 |

| AMSWA | 12 | 56641 | 6 |

| MG | 14 | 44608 | 4 |

| HTBI | 10 | 69092 | 1 |

| Average | 13.25 | 62551 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $63 million. That figure was $22 million in NSSC’s case. Waterstone Financial, Inc. (NASDAQ:WSBF) is the most popular stock in this table. On the other hand Hometrust Bancshares Inc (NASDAQ:HTBI) is the least popular one with only 10 bullish hedge fund positions. Napco Security Technologies Inc (NASDAQ:NSSC) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on NSSC as the stock returned 22.5% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.