Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we publish an article with the title “Recession is Imminent: We Need A Travel Ban NOW”. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in MSCI Inc (NYSE:MSCI)? The smart money sentiment can provide an answer to this question.

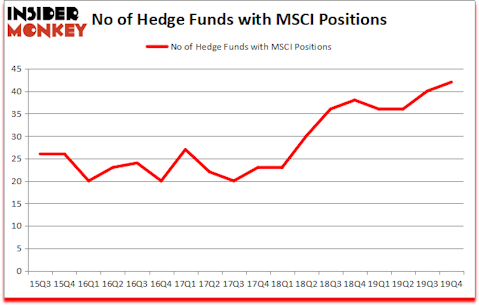

Is MSCI Inc (NYSE:MSCI) ready to rally soon? Money managers are getting more bullish. The number of bullish hedge fund positions moved up by 2 lately. Our calculations also showed that MSCI isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings). MSCI was in 42 hedge funds’ portfolios at the end of the fourth quarter of 2019. There were 40 hedge funds in our database with MSCI positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most stock holders, hedge funds are assumed to be worthless, old financial tools of the past. While there are over 8000 funds in operation today, Our experts look at the top tier of this group, around 850 funds. These money managers handle the lion’s share of the smart money’s total asset base, and by tailing their best stock picks, Insider Monkey has identified a few investment strategies that have historically outpaced the market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

David Harding of Winton Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. Keeping this in mind let’s take a peek at the fresh hedge fund action encompassing MSCI Inc (NYSE:MSCI).

Hedge fund activity in MSCI Inc (NYSE:MSCI)

Heading into the first quarter of 2020, a total of 42 of the hedge funds tracked by Insider Monkey were long this stock, a change of 5% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in MSCI over the last 18 quarters. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in MSCI Inc (NYSE:MSCI), which was worth $226.5 million at the end of the third quarter. On the second spot was Arrowstreet Capital which amassed $68 million worth of shares. GLG Partners, Fisher Asset Management, and Kylin Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Kylin Management allocated the biggest weight to MSCI Inc (NYSE:MSCI), around 11.46% of its 13F portfolio. Harbor Spring Capital is also relatively very bullish on the stock, setting aside 3.03 percent of its 13F equity portfolio to MSCI.

As aggregate interest increased, key hedge funds have jumped into MSCI Inc (NYSE:MSCI) headfirst. Tiger Eye Capital, managed by Ben Gambill, established the biggest position in MSCI Inc (NYSE:MSCI). Tiger Eye Capital had $13.5 million invested in the company at the end of the quarter. David Harding’s Winton Capital Management also initiated a $1.9 million position during the quarter. The other funds with new positions in the stock are Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, Brad Dunkley and Blair Levinsky’s Waratah Capital Advisors, and Michael Gelband’s ExodusPoint Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as MSCI Inc (NYSE:MSCI) but similarly valued. These stocks are Fifth Third Bancorp (NASDAQ:FITB), Ventas, Inc. (NYSE:VTR), Halliburton Company (NYSE:HAL), and Sprint Corporation (NYSE:S). All of these stocks’ market caps are closest to MSCI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FITB | 41 | 845596 | 1 |

| VTR | 29 | 655629 | 13 |

| HAL | 31 | 1208089 | -4 |

| S | 35 | 778974 | 11 |

| Average | 34 | 872072 | 5.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34 hedge funds with bullish positions and the average amount invested in these stocks was $872 million. That figure was $730 million in MSCI’s case. Fifth Third Bancorp (NASDAQ:FITB) is the most popular stock in this table. On the other hand Ventas, Inc. (NYSE:VTR) is the least popular one with only 29 bullish hedge fund positions. Compared to these stocks MSCI Inc (NYSE:MSCI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 12.9% in 2020 through March 9th but still managed to beat the market by 1.9 percentage points. Hedge funds were also right about betting on MSCI as the stock returned 0.1% so far in Q1 (through March 9th) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.