The government requires hedge funds and wealthy investors that crossed the $100 million equity holdings threshold are required to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31. We at Insider Monkey have made an extensive database of nearly 750 of those elite funds and famous investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Millendo Therapeutics, Inc. (NASDAQ:MLND) based on those filings.

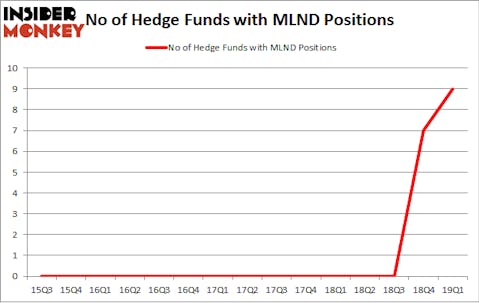

Is Millendo Therapeutics, Inc. (NASDAQ:MLND) a cheap investment now? The smart money is taking an optimistic view. The number of long hedge fund bets inched up by 2 in recent months. Our calculations also showed that mlnd isn’t among the 30 most popular stocks among hedge funds. MLND was in 9 hedge funds’ portfolios at the end of March. There were 7 hedge funds in our database with MLND positions at the end of the previous quarter.

If you’d ask most market participants, hedge funds are perceived as worthless, old investment vehicles of years past. While there are over 8000 funds with their doors open today, Our experts hone in on the top tier of this group, approximately 750 funds. These investment experts oversee bulk of the hedge fund industry’s total asset base, and by following their first-class equity investments, Insider Monkey has brought to light various investment strategies that have historically outrun the market. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to review the recent hedge fund action encompassing Millendo Therapeutics, Inc. (NASDAQ:MLND).

What have hedge funds been doing with Millendo Therapeutics, Inc. (NASDAQ:MLND)?

Heading into the second quarter of 2019, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of 29% from one quarter earlier. By comparison, 0 hedge funds held shares or bullish call options in MLND a year ago. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Among these funds, Frazier Healthcare Partners held the most valuable stake in Millendo Therapeutics, Inc. (NASDAQ:MLND), which was worth $20.9 million at the end of the first quarter. On the second spot was Great Point Partners which amassed $19.3 million worth of shares. Moreover, Prosight Capital, Renaissance Technologies, and Point72 Asset Management were also bullish on Millendo Therapeutics, Inc. (NASDAQ:MLND), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key hedge funds have jumped into Millendo Therapeutics, Inc. (NASDAQ:MLND) headfirst. Millennium Management, managed by Israel Englander, initiated the biggest position in Millendo Therapeutics, Inc. (NASDAQ:MLND). Millennium Management had $0.7 million invested in the company at the end of the quarter. Bradley Louis Radoff’s Fondren Management also made a $0.2 million investment in the stock during the quarter.

Let’s check out hedge fund activity in other stocks similar to Millendo Therapeutics, Inc. (NASDAQ:MLND). We will take a look at American Realty Investors, Inc. (NYSE:ARL), Norwood Financial Corp. (NASDAQ:NWFL), Wrap Technologies, Inc. (NASDAQ:WRTC), and RYB Education, Inc. (NYSE:RYB). This group of stocks’ market caps are closest to MLND’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARL | 1 | 482 | 0 |

| NWFL | 2 | 1768 | 1 |

| WRTC | 2 | 920 | 2 |

| RYB | 7 | 14956 | 0 |

| Average | 3 | 4532 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3 hedge funds with bullish positions and the average amount invested in these stocks was $5 million. That figure was $49 million in MLND’s case. RYB Education, Inc. (NYSE:RYB) is the most popular stock in this table. On the other hand American Realty Investors, Inc. (NYSE:ARL) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Millendo Therapeutics, Inc. (NASDAQ:MLND) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately MLND wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MLND were disappointed as the stock returned -19.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.