Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the second quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 5 years and analyze what the smart money thinks of Manpowergroup Inc (NYSE:MAN) based on that data and determine whether they were really smart about the stock.

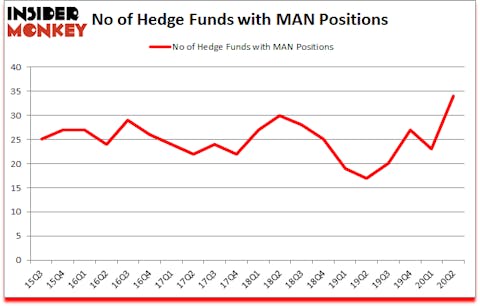

Manpowergroup Inc (NYSE:MAN) investors should pay attention to an increase in support from the world’s most elite money managers recently. Manpowergroup Inc (NYSE:MAN) was in 34 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 30. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 23 hedge funds in our database with MAN positions at the end of the first quarter. Our calculations also showed that MAN isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most traders, hedge funds are viewed as underperforming, old financial tools of years past. While there are greater than 8000 funds trading at present, We choose to focus on the aristocrats of this club, about 850 funds. It is estimated that this group of investors preside over the majority of all hedge funds’ total asset base, and by paying attention to their first-class investments, Insider Monkey has come up with various investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Our portfolio of short stocks lost 34% since February 2017 (through August 17th) even though the market was up 53% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, this “mom” trader turned $2000 into $2 million within 2 years. So, we are checking out her best trade idea of the month. Cannabis stocks are roaring back in 2020, which is why we are also checking out this under-the-radar stock. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now let’s analyze the key hedge fund action surrounding Manpowergroup Inc (NYSE:MAN).

What does smart money think about Manpowergroup Inc (NYSE:MAN)?

At the end of June, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of 48% from the first quarter of 2020. By comparison, 17 hedge funds held shares or bullish call options in MAN a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

Among these funds, AQR Capital Management held the most valuable stake in Manpowergroup Inc (NYSE:MAN), which was worth $160.2 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $43.8 million worth of shares. Arrowstreet Capital, Renaissance Technologies, and Balyasny Asset Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Neo Ivy Capital allocated the biggest weight to Manpowergroup Inc (NYSE:MAN), around 0.44% of its 13F portfolio. Arjuna Capital is also relatively very bullish on the stock, earmarking 0.33 percent of its 13F equity portfolio to MAN.

As industrywide interest jumped, some big names were leading the bulls’ herd. Balyasny Asset Management, managed by Dmitry Balyasny, assembled the most valuable position in Manpowergroup Inc (NYSE:MAN). Balyasny Asset Management had $24.1 million invested in the company at the end of the quarter. Donald Sussman’s Paloma Partners also made a $4.2 million investment in the stock during the quarter. The following funds were also among the new MAN investors: Michael Gelband’s ExodusPoint Capital, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, and Qing Li’s Sciencast Management.

Let’s now take a look at hedge fund activity in other stocks similar to Manpowergroup Inc (NYSE:MAN). These stocks are Integra Lifesciences Holdings Corp (NASDAQ:IART), Darling Ingredients Inc. (NYSE:DAR), BOK Financial Corporation (NASDAQ:BOKF), Wyndham Hotels & Resorts, Inc. (NYSE:WH), Huntsman Corporation (NYSE:HUN), Qurate Retail, Inc. (NASDAQ:QRTEA), and BridgeBio Pharma, Inc. (NASDAQ:BBIO). This group of stocks’ market valuations match MAN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IART | 23 | 101326 | 1 |

| DAR | 25 | 403765 | 0 |

| BOKF | 17 | 203603 | -5 |

| WH | 36 | 760057 | 5 |

| HUN | 25 | 354992 | 4 |

| QRTEA | 43 | 743396 | 11 |

| BBIO | 14 | 1341110 | 2 |

| Average | 26.1 | 558321 | 2.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.1 hedge funds with bullish positions and the average amount invested in these stocks was $558 million. That figure was $377 million in MAN’s case. Qurate Retail, Inc. (NASDAQ:QRTEA) is the most popular stock in this table. On the other hand BridgeBio Pharma, Inc. (NASDAQ:BBIO) is the least popular one with only 14 bullish hedge fund positions. Manpowergroup Inc (NYSE:MAN) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for MAN is 74.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 33% in 2020 through the end of August and beat the market by 23.2 percentage points. Unfortunately MAN wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on MAN were disappointed as the stock returned 6.6% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Manpowergroup Inc. (NYSE:MAN)

Follow Manpowergroup Inc. (NYSE:MAN)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.