We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the first quarter. One of these stocks was Karuna Therapeutics, Inc. (NASDAQ:KRTX).

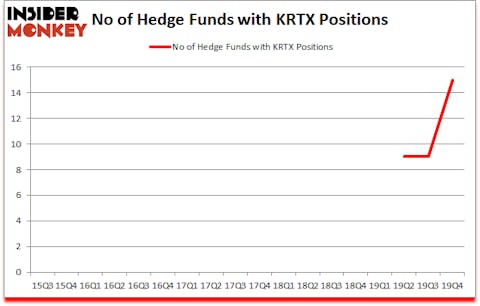

Is Karuna Therapeutics, Inc. (NASDAQ:KRTX) a splendid investment now? Hedge funds are taking an optimistic view. The number of bullish hedge fund bets increased by 6 in recent months. Our calculations also showed that KRTX isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we are checking out investment opportunities like this one. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to take a look at the new hedge fund action encompassing Karuna Therapeutics, Inc. (NASDAQ:KRTX).

Hedge fund activity in Karuna Therapeutics, Inc. (NASDAQ:KRTX)

Heading into the first quarter of 2020, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 67% from the previous quarter. The graph below displays the number of hedge funds with bullish position in KRTX over the last 18 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Among these funds, Partner Fund Management held the most valuable stake in Karuna Therapeutics, Inc. (NASDAQ:KRTX), which was worth $45.4 million at the end of the third quarter. On the second spot was Farallon Capital which amassed $45.2 million worth of shares. Rock Springs Capital Management, Luminus Management, and Vivo Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Copernicus Capital Management allocated the biggest weight to Karuna Therapeutics, Inc. (NASDAQ:KRTX), around 2.57% of its 13F portfolio. Partner Fund Management is also relatively very bullish on the stock, earmarking 2.16 percent of its 13F equity portfolio to KRTX.

As aggregate interest increased, specific money managers have jumped into Karuna Therapeutics, Inc. (NASDAQ:KRTX) headfirst. Farallon Capital, established the most valuable position in Karuna Therapeutics, Inc. (NASDAQ:KRTX). Farallon Capital had $45.2 million invested in the company at the end of the quarter. Jonathan Barrett and Paul Segal’s Luminus Management also initiated a $7 million position during the quarter. The other funds with brand new KRTX positions are Brad Farber’s Atika Capital, Arsani William’s Logos Capital, and D. E. Shaw’s D E Shaw.

Let’s go over hedge fund activity in other stocks similar to Karuna Therapeutics, Inc. (NASDAQ:KRTX). We will take a look at Great Western Bancorp Inc (NYSE:GWB), Workiva Inc (NYSE:WK), Federal Signal Corporation (NYSE:FSS), and Covanta Holding Corporation (NYSE:CVA). All of these stocks’ market caps match KRTX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GWB | 17 | 47873 | 6 |

| WK | 17 | 135876 | -5 |

| FSS | 18 | 90579 | -2 |

| CVA | 19 | 105799 | 5 |

| Average | 17.75 | 95032 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $95 million. That figure was $137 million in KRTX’s case. Covanta Holding Corporation (NYSE:CVA) is the most popular stock in this table. On the other hand Great Western Bancorp Inc (NYSE:GWB) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Karuna Therapeutics, Inc. (NASDAQ:KRTX) is even less popular than GWB. Hedge funds clearly dropped the ball on KRTX as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 13.0% in 2020 through April 6th but still beat the market by 4.2 percentage points. A small number of hedge funds were also right about betting on KRTX as the stock returned -7.3% during the same time period and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.