Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example the Standard and Poor’s 500 Total Return Index ETFs returned 27.5% (including dividend payments) through the end of November. Conversely, hedge funds’ top 20 large-cap stock picks generated a return of nearly 37.4% during the same period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like International Seaways, Inc. (NYSE:INSW).

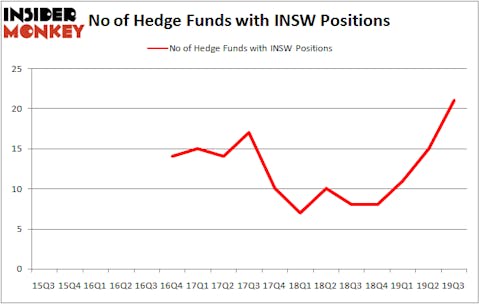

International Seaways, Inc. (NYSE:INSW) was in 21 hedge funds’ portfolios at the end of September. INSW shareholders have witnessed an increase in hedge fund interest recently. There were 15 hedge funds in our database with INSW holdings at the end of the previous quarter. Our calculations also showed that INSW isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most shareholders, hedge funds are perceived as underperforming, outdated investment vehicles of years past. While there are greater than 8000 funds trading at present, We choose to focus on the upper echelon of this group, approximately 750 funds. These investment experts control most of all hedge funds’ total asset base, and by watching their finest investments, Insider Monkey has spotted a number of investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Nathaniel August of Mangrove Partners

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s review the new hedge fund action regarding International Seaways, Inc. (NYSE:INSW).

What does smart money think about International Seaways, Inc. (NYSE:INSW)?

At the end of the third quarter, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 40% from the second quarter of 2019. By comparison, 8 hedge funds held shares or bullish call options in INSW a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Cyrus Capital Partners held the most valuable stake in International Seaways, Inc. (NYSE:INSW), which was worth $77.1 million at the end of the third quarter. On the second spot was Mangrove Partners which amassed $16.7 million worth of shares. Yost Capital Management, Rubric Capital Management, and Paulson & Co were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Yost Capital Management allocated the biggest weight to International Seaways, Inc. (NYSE:INSW), around 17.81% of its 13F portfolio. Cyrus Capital Partners is also relatively very bullish on the stock, earmarking 11 percent of its 13F equity portfolio to INSW.

As industrywide interest jumped, key money managers were leading the bulls’ herd. Hawk Ridge Management, managed by David Brown, created the most valuable position in International Seaways, Inc. (NYSE:INSW). Hawk Ridge Management had $2.2 million invested in the company at the end of the quarter. David Harding’s Winton Capital Management also made a $0.9 million investment in the stock during the quarter. The following funds were also among the new INSW investors: Arvind Sanger’s GeoSphere Capital Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Cliff Asness’s AQR Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as International Seaways, Inc. (NYSE:INSW) but similarly valued. We will take a look at Crawford & Company (NYSE:CRD), The Bancorp, Inc. (NASDAQ:TBBK), The First of Long Island Corporation (NASDAQ:FLIC), and Tufin Software Technologies Ltd. (NYSE:TUFN). This group of stocks’ market caps resemble INSW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CRD | 14 | 36590 | 3 |

| TBBK | 18 | 84515 | 1 |

| FLIC | 10 | 40054 | 1 |

| TUFN | 7 | 7950 | 1 |

| Average | 12.25 | 42277 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $42 million. That figure was $158 million in INSW’s case. The Bancorp, Inc. (NASDAQ:TBBK) is the most popular stock in this table. On the other hand Tufin Software Technologies Ltd. (NYSE:TUFN) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks International Seaways, Inc. (NYSE:INSW) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on INSW as the stock returned 37.5% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.