The 700+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the first quarter, which unveil their equity positions as of March 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Inseego Corp. (NASDAQ:INSG).

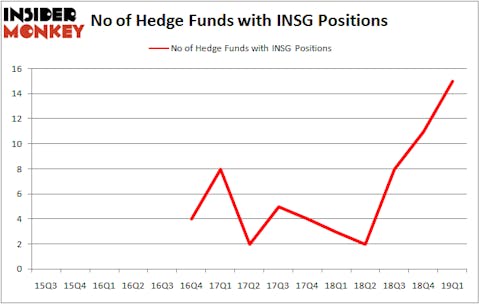

Inseego Corp. (NASDAQ:INSG) shareholders have witnessed an increase in support from the world’s most elite money managers recently. INSG was in 15 hedge funds’ portfolios at the end of the first quarter of 2019. There were 11 hedge funds in our database with INSG holdings at the end of the previous quarter. Our calculations also showed that INSG isn’t among the 30 most popular stocks among hedge funds.

According to most shareholders, hedge funds are perceived as slow, old financial vehicles of the past. While there are greater than 8000 funds trading at present, Our experts hone in on the upper echelon of this group, around 750 funds. These money managers oversee most of all hedge funds’ total asset base, and by monitoring their inimitable stock picks, Insider Monkey has spotted several investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s review the fresh hedge fund action regarding Inseego Corp. (NASDAQ:INSG).

How are hedge funds trading Inseego Corp. (NASDAQ:INSG)?

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 36% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in INSG over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Inseego Corp. (NASDAQ:INSG) was held by Renaissance Technologies, which reported holding $11.1 million worth of stock at the end of March. It was followed by Cannell Capital with a $9.2 million position. Other investors bullish on the company included Arrowstreet Capital, Millennium Management, and Laurion Capital Management.

As industrywide interest jumped, some big names were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, assembled the largest position in Inseego Corp. (NASDAQ:INSG). Arrowstreet Capital had $3.4 million invested in the company at the end of the quarter. Daniel S. Och’s OZ Management also made a $1.5 million investment in the stock during the quarter. The other funds with brand new INSG positions are Ken Griffin’s Citadel Investment Group, Mike Vranos’s Ellington, and David Harding’s Winton Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Inseego Corp. (NASDAQ:INSG) but similarly valued. We will take a look at Armstrong Flooring, Inc. (NYSE:AFI), Constellation Pharmaceuticals, Inc. (NASDAQ:CNST), Carriage Services, Inc. (NYSE:CSV), and Civeo Corporation (NYSE:CVEO). All of these stocks’ market caps resemble INSG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AFI | 12 | 141658 | -1 |

| CNST | 8 | 60492 | 0 |

| CSV | 8 | 33703 | -1 |

| CVEO | 14 | 146012 | 1 |

| Average | 10.5 | 95466 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $95 million. That figure was $33 million in INSG’s case. Civeo Corporation (NYSE:CVEO) is the most popular stock in this table. On the other hand Constellation Pharmaceuticals, Inc. (NASDAQ:CNST) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Inseego Corp. (NASDAQ:INSG) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately INSG wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on INSG were disappointed as the stock returned -4.9% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.