The Insider Monkey team has completed processing the quarterly 13F filings for the June quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Hutchison China MediTech Limited (NASDAQ:HCM).

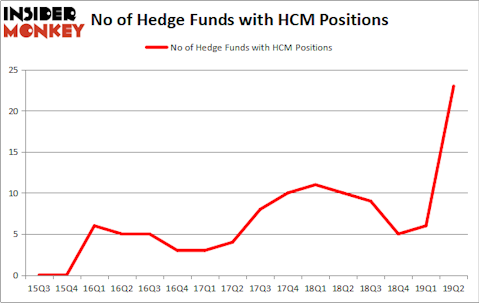

Hutchison China MediTech Limited (NASDAQ:HCM) shareholders have witnessed an increase in enthusiasm from smart money recently. HCM was in 23 hedge funds’ portfolios at the end of June. There were 6 hedge funds in our database with HCM holdings at the end of the previous quarter. Our calculations also showed that HCM isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are many metrics shareholders use to appraise stocks. A pair of the less known metrics are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the elite fund managers can outclass the broader indices by a significant margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s go over the key hedge fund action encompassing Hutchison China MediTech Limited (NASDAQ:HCM).

How are hedge funds trading Hutchison China MediTech Limited (NASDAQ:HCM)?

At the end of the second quarter, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, a change of 283% from the previous quarter. On the other hand, there were a total of 10 hedge funds with a bullish position in HCM a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

The largest stake in Hutchison China MediTech Limited (NASDAQ:HCM) was held by Key Square Capital Management, which reported holding $24.3 million worth of stock at the end of March. It was followed by Segantii Capital with a $19.8 million position. Other investors bullish on the company included Luminus Management, Element Capital Management, and Hudson Bay Capital Management.

Now, key hedge funds were leading the bulls’ herd. Key Square Capital Management, managed by Scott Bessent, created the most valuable position in Hutchison China MediTech Limited (NASDAQ:HCM). Key Square Capital Management had $24.3 million invested in the company at the end of the quarter. Simon Sadler’s Segantii Capital also made a $19.8 million investment in the stock during the quarter. The following funds were also among the new HCM investors: Jonathan Barrett and Paul Segal’s Luminus Management, Jeffrey Talpins’s Element Capital Management, and Steve Cohen’s Point72 Asset Management.

Let’s go over hedge fund activity in other stocks similar to Hutchison China MediTech Limited (NASDAQ:HCM). These stocks are Pivotal Software, Inc. (NYSE:PVTL), Magnolia Oil & Gas Corporation (NYSE:MGY), Dorman Products Inc. (NASDAQ:DORM), and Reata Pharmaceuticals, Inc. (NASDAQ:RETA). All of these stocks’ market caps are similar to HCM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PVTL | 20 | 169491 | -5 |

| MGY | 19 | 172385 | -13 |

| DORM | 14 | 65216 | -1 |

| RETA | 15 | 287383 | -3 |

| Average | 17 | 173619 | -5.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $174 million. That figure was $104 million in HCM’s case. Pivotal Software, Inc. (NYSE:PVTL) is the most popular stock in this table. On the other hand Dorman Products Inc. (NASDAQ:DORM) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Hutchison China MediTech Limited (NASDAQ:HCM) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately HCM wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on HCM were disappointed as the stock returned -18.9% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.