Is Horizon Bancorp, Inc. (NASDAQ:HBNC) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

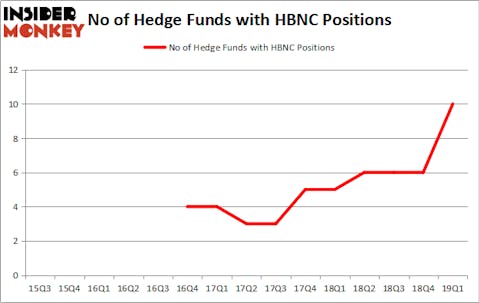

Horizon Bancorp, Inc. (NASDAQ:HBNC) investors should pay attention to an increase in hedge fund interest in recent months. HBNC was in 10 hedge funds’ portfolios at the end of the first quarter of 2019. There were 6 hedge funds in our database with HBNC positions at the end of the previous quarter. Our calculations also showed that HBNC isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a glance at the fresh hedge fund action regarding Horizon Bancorp, Inc. (NASDAQ:HBNC).

How are hedge funds trading Horizon Bancorp, Inc. (NASDAQ:HBNC)?

At Q1’s end, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 67% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in HBNC over the last 15 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Horizon Bancorp, Inc. (NASDAQ:HBNC), which was worth $16.6 million at the end of the first quarter. On the second spot was Minerva Advisors which amassed $0.7 million worth of shares. Moreover, D E Shaw, Two Sigma Advisors, and Citadel Investment Group were also bullish on Horizon Bancorp, Inc. (NASDAQ:HBNC), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key hedge funds were leading the bulls’ herd. Minerva Advisors, managed by David P. Cohen, initiated the most valuable position in Horizon Bancorp, Inc. (NASDAQ:HBNC). Minerva Advisors had $0.7 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $0.3 million investment in the stock during the quarter. The other funds with brand new HBNC positions are David Harding’s Winton Capital Management, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Horizon Bancorp, Inc. (NASDAQ:HBNC) but similarly valued. These stocks are Resolute Forest Products Inc (NYSE:RFP), Viking Therapeutics, Inc. (NASDAQ:VKTX), Johnson Outdoors Inc. (NASDAQ:JOUT), and Univest Corp. of PA (NASDAQ:UVSP). This group of stocks’ market values resemble HBNC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RFP | 23 | 311236 | -4 |

| VKTX | 20 | 72944 | 0 |

| JOUT | 11 | 60260 | -1 |

| UVSP | 9 | 35349 | 4 |

| Average | 15.75 | 119947 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $120 million. That figure was $19 million in HBNC’s case. Resolute Forest Products Inc (NYSE:RFP) is the most popular stock in this table. On the other hand Univest Corp. of PA (NASDAQ:UVSP) is the least popular one with only 9 bullish hedge fund positions. Horizon Bancorp, Inc. (NASDAQ:HBNC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately HBNC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); HBNC investors were disappointed as the stock returned 0.5% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.