Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter. Trends reversed 180 degrees during the first quarter amid Powell’s pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the first quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Hexcel Corporation (NYSE:HXL).

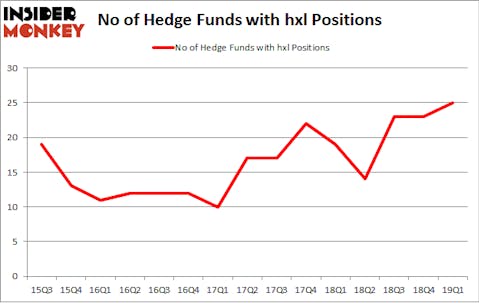

Is Hexcel Corporation (NYSE:HXL) a buy here? Investors who are in the know are becoming more confident. The number of bullish hedge fund positions rose by 2 in recent months. Our calculations also showed that hxl isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a look at the recent hedge fund action encompassing Hexcel Corporation (NYSE:HXL).

Hedge fund activity in Hexcel Corporation (NYSE:HXL)

At the end of the first quarter, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 9% from one quarter earlier. On the other hand, there were a total of 19 hedge funds with a bullish position in HXL a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Millennium Management was the largest shareholder of Hexcel Corporation (NYSE:HXL), with a stake worth $37.2 million reported as of the end of March. Trailing Millennium Management was Joho Capital, which amassed a stake valued at $29.3 million. D E Shaw, Marshall Wace LLP, and Markel Gayner Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Renaissance Technologies, managed by Jim Simons, created the largest position in Hexcel Corporation (NYSE:HXL). Renaissance Technologies had $9.3 million invested in the company at the end of the quarter. Peter Muller’s PDT Partners also made a $4 million investment in the stock during the quarter. The following funds were also among the new HXL investors: Cliff Asness’s AQR Capital Management, Matthew Tewksbury’s Stevens Capital Management, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s go over hedge fund activity in other stocks similar to Hexcel Corporation (NYSE:HXL). These stocks are XPO Logistics Inc (NYSE:XPO), National Instruments Corporation (NASDAQ:NATI), Healthcare Trust Of America Inc (NYSE:HTA), and Assurant, Inc. (NYSE:AIZ). All of these stocks’ market caps match HXL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XPO | 26 | 2005525 | -18 |

| NATI | 28 | 604817 | -1 |

| HTA | 19 | 458711 | 2 |

| AIZ | 39 | 617750 | 8 |

| Average | 28 | 921701 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $922 million. That figure was $176 million in HXL’s case. Assurant, Inc. (NYSE:AIZ) is the most popular stock in this table. On the other hand Healthcare Trust Of America Inc (NYSE:HTA) is the least popular one with only 19 bullish hedge fund positions. Hexcel Corporation (NYSE:HXL) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on HXL as the stock returned 6% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.