Is HDFC Bank Limited (NYSE:HDB) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

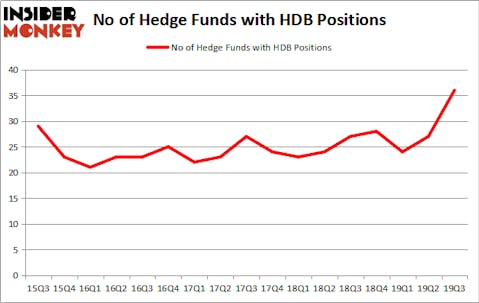

HDFC Bank Limited (NYSE:HDB) has seen an increase in enthusiasm from smart money of late. HDB was in 36 hedge funds’ portfolios at the end of September. There were 27 hedge funds in our database with HDB positions at the end of the previous quarter. Our calculations also showed that HDB isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are numerous formulas shareholders can use to size up publicly traded companies. Two of the most innovative formulas are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the best investment managers can outclass the S&P 500 by a healthy amount (see the details here).

Stanley Druckenmiller of Duquesne Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to check out the new hedge fund action surrounding HDFC Bank Limited (NYSE:HDB).

What does smart money think about HDFC Bank Limited (NYSE:HDB)?

At the end of the third quarter, a total of 36 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 33% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in HDB over the last 17 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, GQG Partners held the most valuable stake in HDFC Bank Limited (NYSE:HDB), which was worth $1020.5 million at the end of the third quarter. On the second spot was Fisher Asset Management which amassed $453 million worth of shares. Two Creeks Capital Management, Steadfast Capital Management, and Samlyn Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position TPG-AXON Management LP allocated the biggest weight to HDFC Bank Limited (NYSE:HDB), around 12.91% of its portfolio. Prince Street Capital Management is also relatively very bullish on the stock, dishing out 12.91 percent of its 13F equity portfolio to HDB.

As one would reasonably expect, specific money managers were leading the bulls’ herd. LMR Partners, managed by Ben Levine, Andrew Manuel and Stefan Renold, assembled the biggest position in HDFC Bank Limited (NYSE:HDB). LMR Partners had $56 million invested in the company at the end of the quarter. Stanley Druckenmiller’s Duquesne Capital also made a $48.4 million investment in the stock during the quarter. The other funds with new positions in the stock are Renaissance Technologies, Shashin Shah’s Think Investments, and Josh Donfeld and David Rogers’s Castle Hook Partners.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as HDFC Bank Limited (NYSE:HDB) but similarly valued. We will take a look at Uber Technologies, Inc. (NYSE:UBER), Intercontinental Exchange Inc (NYSE:ICE), The Sherwin-Williams Company (NYSE:SHW), and Marsh & McLennan Companies, Inc. (NYSE:MMC). This group of stocks’ market caps are similar to HDB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UBER | 45 | 3397033 | -11 |

| ICE | 43 | 2290732 | 8 |

| SHW | 45 | 1587764 | 5 |

| MMC | 26 | 579695 | -3 |

| Average | 39.75 | 1963806 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39.75 hedge funds with bullish positions and the average amount invested in these stocks was $1964 million. That figure was $2348 million in HDB’s case. Uber Technologies, Inc. (NYSE:UBER) is the most popular stock in this table. On the other hand Marsh & McLennan Companies, Inc. (NYSE:MMC) is the least popular one with only 26 bullish hedge fund positions. HDFC Bank Limited (NYSE:HDB) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on HDB, though not to the same extent, as the stock returned 8.2% during the first two months of the fourth quarter and outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.