We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD).

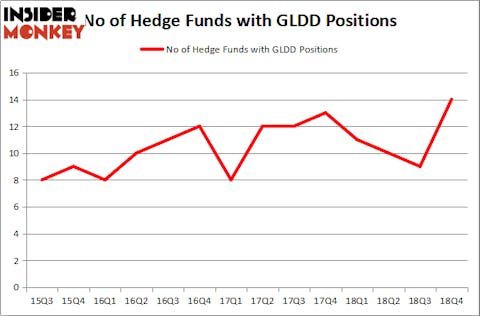

Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD) investors should pay attention to an increase in hedge fund sentiment of late. GLDD was in 14 hedge funds’ portfolios at the end of December. There were 9 hedge funds in our database with GLDD positions at the end of the previous quarter. Our calculations also showed that GLDD isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a peek at the fresh hedge fund action surrounding Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD).

How have hedgies been trading Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD)?

At the end of the fourth quarter, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 56% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GLDD over the last 14 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

Among these funds, Wynnefield Capital held the most valuable stake in Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD), which was worth $10 million at the end of the fourth quarter. On the second spot was D E Shaw which amassed $6.4 million worth of shares. Moreover, Royce & Associates, Prescott Group Capital Management, and Millennium Management were also bullish on Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, specific money managers were breaking ground themselves. Millennium Management, managed by Israel Englander, assembled the biggest position in Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD). Millennium Management had $2.2 million invested in the company at the end of the quarter. Mike Vranos’s Ellington also initiated a $0.3 million position during the quarter. The following funds were also among the new GLDD investors: Thomas Bailard’s Bailard Inc, Paul Tudor Jones’s Tudor Investment Corp, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now review hedge fund activity in other stocks similar to Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD). We will take a look at One Madison Corporation (NYSE:OMAD), Ducommun Incorporated (NYSE:DCO), Evelo Biosciences, Inc. (NASDAQ:EVLO), and Prothena Corporation plc (NASDAQ:PRTA). This group of stocks’ market values match GLDD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OMAD | 11 | 55695 | -3 |

| DCO | 10 | 45398 | 2 |

| EVLO | 3 | 8369 | 2 |

| PRTA | 13 | 209619 | -1 |

| Average | 9.25 | 79770 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.25 hedge funds with bullish positions and the average amount invested in these stocks was $80 million. That figure was $36 million in GLDD’s case. Prothena Corporation plc (NASDAQ:PRTA) is the most popular stock in this table. On the other hand Evelo Biosciences, Inc. (NASDAQ:EVLO) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on GLDD as the stock returned 47.1% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.