Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Gores Metropoulos, Inc. (NASDAQ:GMHI) from the perspective of those elite funds.

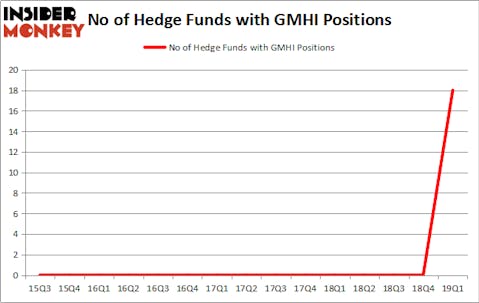

Gores Metropoulos, Inc. (NASDAQ:GMHI) has experienced an increase in activity from the world’s largest hedge funds lately. GMHI was in 18 hedge funds’ portfolios at the end of March. There were 0 hedge funds in our database with GMHI positions at the end of the previous quarter. Our calculations also showed that GMHI isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s check out the latest hedge fund action regarding Gores Metropoulos, Inc. (NASDAQ:GMHI).

How have hedgies been trading Gores Metropoulos, Inc. (NASDAQ:GMHI)?

Heading into the second quarter of 2019, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a change of 18 from one quarter earlier. On the other hand, there were a total of 0 hedge funds with a bullish position in GMHI a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Arrowgrass Capital Partners, managed by Nick Niell, holds the biggest position in Gores Metropoulos, Inc. (NASDAQ:GMHI). Arrowgrass Capital Partners has a $20.5 million position in the stock, comprising 0.6% of its 13F portfolio. Sitting at the No. 2 spot is Governors Lane, led by Isaac Corre, holding a $20.5 million position; 1.5% of its 13F portfolio is allocated to the stock. Remaining hedge funds and institutional investors that are bullish contain Israel Englander’s Millennium Management, Jeffrey Talpins’s Element Capital Management and Mitch Kuflik and Rob Sobel’s Brahman Capital.

Consequently, key hedge funds have been driving this bullishness. Arrowgrass Capital Partners, managed by Nick Niell, established the biggest position in Gores Metropoulos, Inc. (NASDAQ:GMHI). Arrowgrass Capital Partners had $20.5 million invested in the company at the end of the quarter. Isaac Corre’s Governors Lane also made a $20.5 million investment in the stock during the quarter. The following funds were also among the new GMHI investors: Israel Englander’s Millennium Management, Jeffrey Talpins’s Element Capital Management, and Mitch Kuflik and Rob Sobel’s Brahman Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Gores Metropoulos, Inc. (NASDAQ:GMHI) but similarly valued. These stocks are Bank First National Corporation (NASDAQ:BFC), Albireo Pharma, Inc. (NASDAQ:ALBO), Tekla Life Sciences Investors (NYSE:HQL), and Tekla World Healthcare Fund (NYSE:THW). This group of stocks’ market caps match GMHI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BFC | 4 | 4587 | 4 |

| ALBO | 13 | 95457 | 1 |

| HQL | 2 | 678 | 0 |

| THW | 1 | 283 | 0 |

| Average | 5 | 25251 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5 hedge funds with bullish positions and the average amount invested in these stocks was $25 million. That figure was $172 million in GMHI’s case. Albireo Pharma, Inc. (NASDAQ:ALBO) is the most popular stock in this table. On the other hand Tekla World Healthcare Fund (NYSE:THW) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Gores Metropoulos, Inc. (NASDAQ:GMHI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately GMHI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on GMHI were disappointed as the stock returned 2.6% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.