Is GenMark Diagnostics, Inc (NASDAQ:GNMK) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

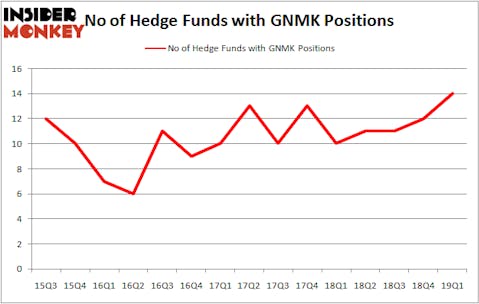

GenMark Diagnostics, Inc (NASDAQ:GNMK) shareholders have witnessed an increase in hedge fund interest of late. Our calculations also showed that GNMK isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are several formulas stock market investors have at their disposal to grade stocks. A duo of the less utilized formulas are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the top fund managers can beat the broader indices by a significant amount (see the details here).

Noam Gottesman, GLG Partners

We’re going to review the new hedge fund action regarding GenMark Diagnostics, Inc (NASDAQ:GNMK).

How are hedge funds trading GenMark Diagnostics, Inc (NASDAQ:GNMK)?

At Q1’s end, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in GNMK over the last 15 quarters. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Cadian Capital, managed by Eric Bannasch, holds the biggest position in GenMark Diagnostics, Inc (NASDAQ:GNMK). Cadian Capital has a $36.5 million position in the stock, comprising 1.4% of its 13F portfolio. Sitting at the No. 2 spot is Eli Casdin of Casdin Capital, with a $23.9 million position; 2.6% of its 13F portfolio is allocated to the company. Remaining professional money managers with similar optimism contain Israel Englander’s Millennium Management, Anand Parekh’s Alyeska Investment Group and D. E. Shaw’s D E Shaw.

Consequently, specific money managers were breaking ground themselves. GLG Partners, managed by Noam Gottesman, initiated the largest position in GenMark Diagnostics, Inc (NASDAQ:GNMK). GLG Partners had $1 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also made a $0.9 million investment in the stock during the quarter. The other funds with new positions in the stock are Jeffrey Talpins’s Element Capital Management and Cliff Asness’s AQR Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to GenMark Diagnostics, Inc (NASDAQ:GNMK). We will take a look at Avalon GloboCare Corp. (NASDAQ:AVCO), Agenus Inc (NASDAQ:AGEN), Safehold Inc (NYSE:SAFE), and Anworth Mortgage Asset Corporation (NYSE:ANH). This group of stocks’ market valuations match GNMK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVCO | 3 | 1423 | 2 |

| AGEN | 7 | 13653 | 0 |

| SAFE | 1 | 1784 | -1 |

| ANH | 9 | 31711 | 0 |

| Average | 5 | 12143 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5 hedge funds with bullish positions and the average amount invested in these stocks was $12 million. That figure was $76 million in GNMK’s case. Anworth Mortgage Asset Corporation (NYSE:ANH) is the most popular stock in this table. On the other hand Safehold Inc. (NYSE:SAFE) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks GenMark Diagnostics, Inc (NASDAQ:GNMK) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately GNMK wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on GNMK were disappointed as the stock returned -3.1% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.