Before we spend countless hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Fluidigm Corporation (NASDAQ:FLDM).

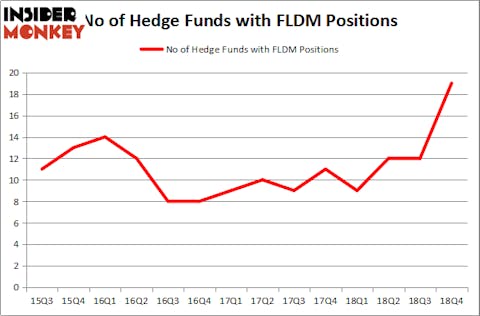

Is Fluidigm Corporation (NASDAQ:FLDM) a bargain? The smart money is betting on the stock. The number of bullish hedge fund positions rose by 7 recently. Our calculations also showed that FLDM isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a glance at the latest hedge fund action encompassing Fluidigm Corporation (NASDAQ:FLDM).

What does the smart money think about Fluidigm Corporation (NASDAQ:FLDM)?

At Q4’s end, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 58% from one quarter earlier. By comparison, 9 hedge funds held shares or bullish call options in FLDM a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Levin Capital Strategies, managed by John A. Levin, holds the number one position in Fluidigm Corporation (NASDAQ:FLDM). Levin Capital Strategies has a $82.5 million position in the stock, comprising 1.8% of its 13F portfolio. Sitting at the No. 2 spot is Driehaus Capital, managed by Richard Driehaus, which holds a $19.9 million position; 0.9% of its 13F portfolio is allocated to the stock. Other professional money managers that hold long positions contain Jim Simons’s Renaissance Technologies, Israel Englander’s Millennium Management and Efrem Kamen’s Pura Vida Investments.

As aggregate interest increased, key money managers were breaking ground themselves. Driehaus Capital, managed by Richard Driehaus, initiated the biggest position in Fluidigm Corporation (NASDAQ:FLDM). Driehaus Capital had $19.9 million invested in the company at the end of the quarter. Derek C. Schrier’s Indaba Capital Management also initiated a $3.4 million position during the quarter. The other funds with new positions in the stock are Chuck Royce’s Royce & Associates, James Dondero’s Highland Capital Management, and Benjamin A. Smith’s Laurion Capital Management.

Let’s go over hedge fund activity in other stocks similar to Fluidigm Corporation (NASDAQ:FLDM). We will take a look at Attunity Ltd (NASDAQ:ATTU), U.S. Well Services, Inc. (NASDAQ:USWS), Unifi, Inc. (NYSE:UFI), and Axonics Modulation Technologies, Inc. (NASDAQ:AXNX). All of these stocks’ market caps resemble FLDM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATTU | 17 | 84857 | 4 |

| USWS | 14 | 32349 | -1 |

| UFI | 10 | 80864 | -4 |

| AXNX | 10 | 66177 | 10 |

| Average | 12.75 | 66062 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $66 million. That figure was $145 million in FLDM’s case. Attunity Ltd (NASDAQ:ATTU) is the most popular stock in this table. On the other hand Unifi, Inc. (NYSE:UFI) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Fluidigm Corporation (NASDAQ:FLDM) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on FLDM as the stock returned 48.4% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.