Hedge funds run by legendary names like George Soros and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

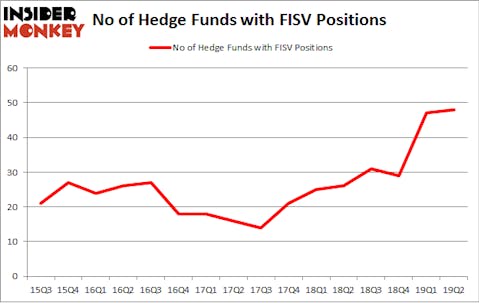

Fiserv, Inc. (NASDAQ:FISV) investors should be aware of an increase in hedge fund interest in recent months. Our calculations also showed that FISV isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are seen as underperforming, old investment vehicles of years past. While there are over 8000 funds in operation at the moment, Our researchers choose to focus on the aristocrats of this club, about 750 funds. These money managers shepherd the lion’s share of the hedge fund industry’s total capital, and by keeping track of their highest performing equity investments, Insider Monkey has come up with a few investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points annually since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the recent hedge fund action surrounding Fiserv, Inc. (NASDAQ:FISV).

What does smart money think about Fiserv, Inc. (NASDAQ:FISV)?

At Q2’s end, a total of 48 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 2% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards FISV over the last 16 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Fiserv, Inc. (NASDAQ:FISV) was held by Egerton Capital Limited, which reported holding $361.6 million worth of stock at the end of March. It was followed by Kensico Capital with a $260.9 million position. Other investors bullish on the company included Eagle Capital Management, Two Sigma Advisors, and Renaissance Technologies.

Consequently, key hedge funds have jumped into Fiserv, Inc. (NASDAQ:FISV) headfirst. Glazer Capital, managed by Paul Glazer, established the most valuable position in Fiserv, Inc. (NASDAQ:FISV). Glazer Capital had $49.4 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also initiated a $49.2 million position during the quarter. The other funds with new positions in the stock are Brian Ashford-Russell and Tim Woolley’s Polar Capital, Aaron Cowen’s Suvretta Capital Management, and Clint Carlson’s Carlson Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Fiserv, Inc. (NASDAQ:FISV) but similarly valued. These stocks are Altaba Inc. (NASDAQ:AABA), SYSCO Corporation (NYSE:SYY), Cognizant Technology Solutions Corporation (NASDAQ:CTSH), and Mizuho Financial Group Inc. (NYSE:MFG). All of these stocks’ market caps resemble FISV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AABA | 59 | 13834865 | -17 |

| SYY | 31 | 2706154 | -5 |

| CTSH | 33 | 2283082 | -11 |

| MFG | 6 | 22357 | 4 |

| Average | 32.25 | 4711615 | -7.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.25 hedge funds with bullish positions and the average amount invested in these stocks was $4712 million. That figure was $2257 million in FISV’s case. Altaba Inc. (NASDAQ:AABA) is the most popular stock in this table. On the other hand Mizuho Financial Group Inc. (NYSE:MFG) is the least popular one with only 6 bullish hedge fund positions. Fiserv, Inc. (NASDAQ:FISV) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks (see the video below) among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on FISV as the stock returned 13.6% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.