Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 12.1% in 2019 (through May 30th). Conversely, hedge funds’ 20 preferred S&P 500 stocks generated a return of 18.7% during the same period, with the majority of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like First Commonwealth Financial Corporation (NYSE:FCF).

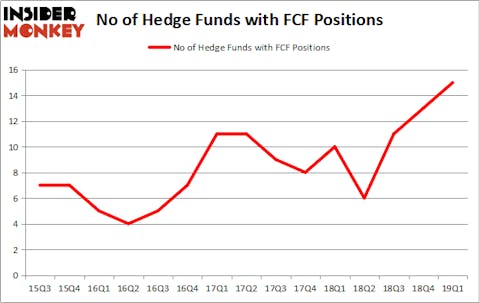

Is First Commonwealth Financial Corporation (NYSE:FCF) a buy, sell, or hold? The best stock pickers are buying. The number of long hedge fund bets inched up by 2 recently. Our calculations also showed that FCF isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are several methods stock traders can use to grade publicly traded companies. A pair of the most under-the-radar methods are hedge fund and insider trading moves. We have shown that, historically, those who follow the top picks of the best hedge fund managers can outpace the market by a superb amount (see the details here).

We’re going to take a peek at the latest hedge fund action surrounding First Commonwealth Financial Corporation (NYSE:FCF).

How are hedge funds trading First Commonwealth Financial Corporation (NYSE:FCF)?

At the end of the first quarter, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 15% from the previous quarter. On the other hand, there were a total of 10 hedge funds with a bullish position in FCF a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of First Commonwealth Financial Corporation (NYSE:FCF), with a stake worth $20.4 million reported as of the end of March. Trailing Renaissance Technologies was Millennium Management, which amassed a stake valued at $6.8 million. Citadel Investment Group, D E Shaw, and PDT Partners were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, key money managers were leading the bulls’ herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, created the most outsized position in First Commonwealth Financial Corporation (NYSE:FCF). Marshall Wace LLP had $1.5 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $1.5 million investment in the stock during the quarter. The other funds with brand new FCF positions are Benjamin A. Smith’s Laurion Capital Management, Michael Platt and William Reeves’s BlueCrest Capital Mgmt., and Hoon Kim’s Quantinno Capital.

Let’s now review hedge fund activity in other stocks similar to First Commonwealth Financial Corporation (NYSE:FCF). These stocks are Gentherm Inc (NASDAQ:THRM), Berkshire Hills Bancorp, Inc. (NYSE:BHLB), OceanFirst Financial Corp. (NASDAQ:OCFC), and Camping World Holdings, Inc. (NYSE:CWH). All of these stocks’ market caps resemble FCF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| THRM | 19 | 75339 | 2 |

| BHLB | 13 | 50982 | 2 |

| OCFC | 13 | 60218 | 1 |

| CWH | 10 | 103692 | -1 |

| Average | 13.75 | 72558 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $73 million. That figure was $41 million in FCF’s case. Gentherm Inc (NASDAQ:THRM) is the most popular stock in this table. On the other hand Camping World Holdings, Inc. (NYSE:CWH) is the least popular one with only 10 bullish hedge fund positions. First Commonwealth Financial Corporation (NYSE:FCF) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately FCF wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on FCF were disappointed as the stock returned 1.9% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.