Is Cubic Corporation (NYSE:CUB) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

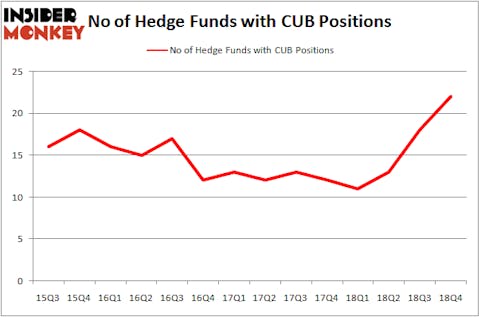

Is Cubic Corporation (NYSE:CUB) undervalued? Money managers are becoming hopeful. The number of long hedge fund positions increased by 4 recently. Our calculations also showed that CUB isn’t among the 30 most popular stocks among hedge funds. CUB was in 22 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 18 hedge funds in our database with CUB positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to go over the recent hedge fund action encompassing Cubic Corporation (NYSE:CUB).

How are hedge funds trading Cubic Corporation (NYSE:CUB)?

At the end of the fourth quarter, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 22% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CUB over the last 14 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

More specifically, Daruma Asset Management was the largest shareholder of Cubic Corporation (NYSE:CUB), with a stake worth $25.9 million reported as of the end of December. Trailing Daruma Asset Management was Citadel Investment Group, which amassed a stake valued at $11.6 million. Rutabaga Capital Management, Alyeska Investment Group, and Laurion Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, key hedge funds have jumped into Cubic Corporation (NYSE:CUB) headfirst. Alyeska Investment Group, managed by Anand Parekh, created the largest position in Cubic Corporation (NYSE:CUB). Alyeska Investment Group had $7.4 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also initiated a $6.6 million position during the quarter. The other funds with brand new CUB positions are Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, Matthew Hulsizer’s PEAK6 Capital Management, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s check out hedge fund activity in other stocks similar to Cubic Corporation (NYSE:CUB). These stocks are State Auto Financial Corporation (NASDAQ:STFC), Meritage Homes Corp (NYSE:MTH), JELD-WEN Holding, Inc. (NYSE:JELD), and MicroStrategy Incorporated (NASDAQ:MSTR). This group of stocks’ market caps match CUB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STFC | 4 | 16052 | 1 |

| MTH | 13 | 156459 | 0 |

| JELD | 16 | 291975 | 3 |

| MSTR | 23 | 141808 | -2 |

| Average | 14 | 151574 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $152 million. That figure was $97 million in CUB’s case. MicroStrategy Incorporated (NASDAQ:MSTR) is the most popular stock in this table. On the other hand State Auto Financial Corporation (NASDAQ:STFC) is the least popular one with only 4 bullish hedge fund positions. Cubic Corporation (NYSE:CUB) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CUB wasn’t nearly as popular as these 15 stock and hedge funds that were betting on CUB were disappointed as the stock returned 1.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.