Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 5 months of this year through May 30th the Standard and Poor’s 500 Index returned approximately 12.1% (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the same 5-month period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like Credit Acceptance Corp. (NASDAQ:CACC).

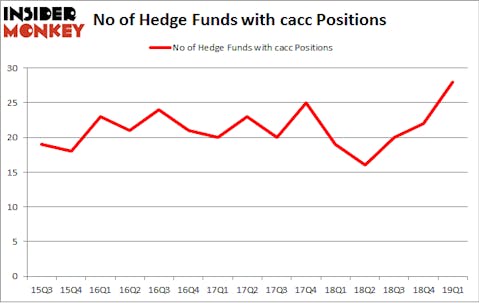

Credit Acceptance Corp. (NASDAQ:CACC) shareholders have witnessed an increase in hedge fund sentiment recently. CACC was in 28 hedge funds’ portfolios at the end of March. There were 22 hedge funds in our database with CACC holdings at the end of the previous quarter. Our calculations also showed that cacc isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a gander at the key hedge fund action encompassing Credit Acceptance Corp. (NASDAQ:CACC).

How have hedgies been trading Credit Acceptance Corp. (NASDAQ:CACC)?

At Q1’s end, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 27% from the previous quarter. On the other hand, there were a total of 19 hedge funds with a bullish position in CACC a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Credit Acceptance Corp. (NASDAQ:CACC) was held by BloombergSen, which reported holding $223.6 million worth of stock at the end of March. It was followed by Abrams Bison Investments with a $220.1 million position. Other investors bullish on the company included Cantillon Capital Management, Gobi Capital, and Hound Partners.

As aggregate interest increased, key money managers were leading the bulls’ herd. LMR Partners, managed by Ben Levine, Andrew Manuel and Stefan Renold, established the most outsized position in Credit Acceptance Corp. (NASDAQ:CACC). LMR Partners had $13.6 million invested in the company at the end of the quarter. Peter Muller’s PDT Partners also initiated a $4.8 million position during the quarter. The following funds were also among the new CACC investors: Matthew Hulsizer’s PEAK6 Capital Management, Israel Englander’s Millennium Management, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s now take a look at hedge fund activity in other stocks similar to Credit Acceptance Corp. (NASDAQ:CACC). We will take a look at Lear Corporation (NYSE:LEA), Under Armour Inc (NYSE:UA), Whirlpool Corporation (NYSE:WHR), and Zions Bancorporation, National Association (NASDAQ:ZION). This group of stocks’ market valuations match CACC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LEA | 40 | 804768 | 11 |

| UA | 30 | 934725 | 3 |

| WHR | 18 | 547948 | -2 |

| ZION | 44 | 631442 | 2 |

| Average | 33 | 729721 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33 hedge funds with bullish positions and the average amount invested in these stocks was $730 million. That figure was $1090 million in CACC’s case. Zions Bancorporation, National Association (NASDAQ:ZION) is the most popular stock in this table. On the other hand Whirlpool Corporation (NYSE:WHR) is the least popular one with only 18 bullish hedge fund positions. Credit Acceptance Corp. (NASDAQ:CACC) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on CACC as the stock returned 2.5% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.