The financial regulations require hedge funds and wealthy investors that exceeded the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31st, about a week after the S&P 500 Index bottomed. We at Insider Monkey have made an extensive database of more than 821 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Coupa Software Incorporated (NASDAQ:COUP) based on those filings.

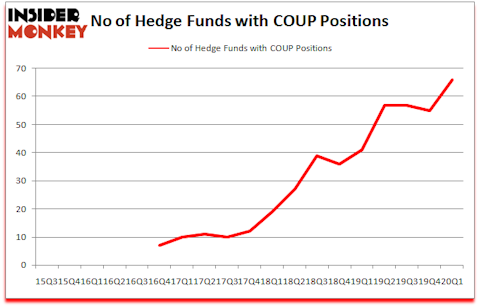

Coupa Software Incorporated (NASDAQ:COUP) shareholders have witnessed an increase in enthusiasm from smart money lately. COUP was in 66 hedge funds’ portfolios at the end of March. There were 55 hedge funds in our database with COUP positions at the end of the previous quarter. Our calculations also showed that COUP isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

According to most traders, hedge funds are viewed as unimportant, old investment vehicles of years past. While there are more than 8000 funds trading today, We choose to focus on the elite of this group, about 850 funds. These hedge fund managers command the lion’s share of all hedge funds’ total capital, and by shadowing their inimitable investments, Insider Monkey has come up with a few investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

New York Stock Exchange

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, Europe is set to become the world’s largest cannabis market, so we checked out this European marijuana stock pitch. Also, we are still not out of the woods in terms of the coronavirus pandemic. So, we checked out this analyst’s “corona catalyst plays“. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to check out the key hedge fund action regarding Coupa Software Incorporated (NASDAQ:COUP).

Hedge fund activity in Coupa Software Incorporated (NASDAQ:COUP)

Heading into the second quarter of 2020, a total of 66 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 20% from the fourth quarter of 2019. The graph below displays the number of hedge funds with bullish position in COUP over the last 18 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

More specifically, Sylebra Capital Management was the largest shareholder of Coupa Software Incorporated (NASDAQ:COUP), with a stake worth $304.7 million reported as of the end of September. Trailing Sylebra Capital Management was Lone Pine Capital, which amassed a stake valued at $296.8 million. Alkeon Capital Management, Whale Rock Capital Management, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Crosslink Capital allocated the biggest weight to Coupa Software Incorporated (NASDAQ:COUP), around 19.93% of its 13F portfolio. Center Lake Capital is also relatively very bullish on the stock, setting aside 17.38 percent of its 13F equity portfolio to COUP.

Consequently, some big names have jumped into Coupa Software Incorporated (NASDAQ:COUP) headfirst. OZ Management, managed by Daniel S. Och, initiated the most valuable position in Coupa Software Incorporated (NASDAQ:COUP). OZ Management had $35.9 million invested in the company at the end of the quarter. Nancy Zevenbergen’s Zevenbergen Capital Investments also initiated a $27.4 million position during the quarter. The other funds with new positions in the stock are David Goel and Paul Ferri’s Matrix Capital Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Principal Global Investors’s Columbus Circle Investors.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Coupa Software Incorporated (NASDAQ:COUP) but similarly valued. These stocks are The AES Corporation (NYSE:AES), Teradyne, Inc. (NASDAQ:TER), ONEOK, Inc. (NYSE:OKE), and Medical Properties Trust, Inc. (NYSE:MPW). This group of stocks’ market valuations are closest to COUP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AES | 31 | 445516 | 4 |

| TER | 28 | 842457 | -5 |

| OKE | 25 | 135073 | -6 |

| MPW | 16 | 164781 | 2 |

| Average | 25 | 396957 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $397 million. That figure was $2184 million in COUP’s case. The AES Corporation (NYSE:AES) is the most popular stock in this table. On the other hand Medical Properties Trust, Inc. (NYSE:MPW) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Coupa Software Incorporated (NASDAQ:COUP) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 7.9% in 2020 through May 22nd but still managed to beat the market by 15.6 percentage points. Hedge funds were also right about betting on COUP as the stock returned 62.8% so far in Q2 (through May 22nd) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.