After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of June 28. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Corindus Vascular Robotics Inc (NYSE:CVRS).

Corindus Vascular Robotics Inc (NYSE:CVRS) investors should be aware of an increase in enthusiasm from smart money in recent months. Our calculations also showed that CVRS isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the fresh hedge fund action regarding Corindus Vascular Robotics Inc (NYSE:CVRS).

What does smart money think about Corindus Vascular Robotics Inc (NYSE:CVRS)?

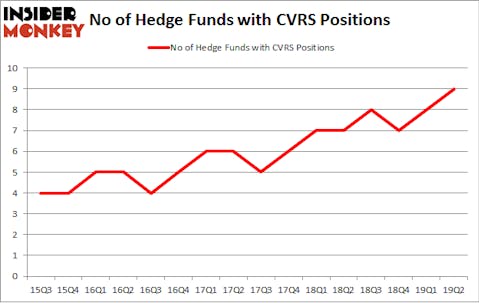

Heading into the third quarter of 2019, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards CVRS over the last 16 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Healthcor Management LP, managed by Arthur B Cohen and Joseph Healey, holds the most valuable position in Corindus Vascular Robotics Inc (NYSE:CVRS). Healthcor Management LP has a $59.5 million position in the stock, comprising 2.3% of its 13F portfolio. On Healthcor Management LP’s heels is Hudson Executive Capital, managed by Douglas Braunstein and James Woolery, which holds a $42.4 million position; the fund has 4.1% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions contain Israel Englander’s Millennium Management, Mike Masters’s Masters Capital Management and Renaissance Technologies.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Two Sigma Advisors, managed by John Overdeck and David Siegel, initiated the biggest position in Corindus Vascular Robotics Inc (NYSE:CVRS). Two Sigma Advisors had $0.2 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also made a $0.1 million investment in the stock during the quarter. The only other fund with a brand new CVRS position is Joel Greenblatt’s Gotham Asset Management.

Let’s now review hedge fund activity in other stocks similar to Corindus Vascular Robotics Inc (NYSE:CVRS). These stocks are Costamare Inc (NYSE:CMRE), Summit Midstream Partners LP (NYSE:SMLP), Himax Technologies, Inc. (NASDAQ:HIMX), and Koppers Holdings Inc. (NYSE:KOP). This group of stocks’ market values resemble CVRS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMRE | 10 | 18148 | 1 |

| SMLP | 4 | 800 | 2 |

| HIMX | 8 | 18514 | -1 |

| KOP | 12 | 40629 | -1 |

| Average | 8.5 | 19523 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $20 million. That figure was $144 million in CVRS’s case. Koppers Holdings Inc. (NYSE:KOP) is the most popular stock in this table. On the other hand Summit Midstream Partners LP (NYSE:SMLP) is the least popular one with only 4 bullish hedge fund positions. Corindus Vascular Robotics Inc (NYSE:CVRS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on CVRS as the stock returned 43.6% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.