How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Cloudera, Inc. (NYSE:CLDR).

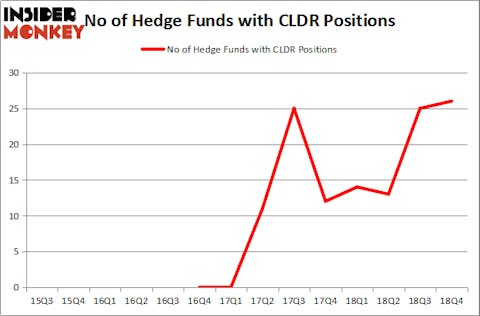

Is Cloudera, Inc. (NYSE:CLDR) the right investment to pursue these days? The smart money is betting on the stock. The number of long hedge fund positions advanced by 1 recently. Our calculations also showed that CLDR isn’t among the 30 most popular stocks among hedge funds. CLDR was in 26 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 25 hedge funds in our database with CLDR holdings at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s view the fresh hedge fund action regarding Cloudera, Inc. (NYSE:CLDR).

How are hedge funds trading Cloudera, Inc. (NYSE:CLDR)?

At Q4’s end, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the previous quarter. On the other hand, there were a total of 14 hedge funds with a bullish position in CLDR a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Cloudera, Inc. (NYSE:CLDR) was held by Renaissance Technologies, which reported holding $52.8 million worth of stock at the end of December. It was followed by Millennium Management with a $16.7 million position. Other investors bullish on the company included Citadel Investment Group, Brookside Capital, and Raging Capital Management.

Now, some big names have been driving this bullishness. Raging Capital Management, managed by William C. Martin, initiated the biggest position in Cloudera, Inc. (NYSE:CLDR). Raging Capital Management had $7.1 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also initiated a $6.1 million position during the quarter. The other funds with new positions in the stock are Spencer M. Waxman’s Shannon River Fund Management, Mariko Gordon’s Daruma Asset Management, and Daniel Arbess’s Perella Weinberg Partners.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Cloudera, Inc. (NYSE:CLDR) but similarly valued. These stocks are ServisFirst Bancshares, Inc. (NASDAQ:SFBS), Dycom Industries, Inc. (NYSE:DY), KB Home (NYSE:KBH), and Carpenter Technology Corporation (NYSE:CRS). This group of stocks’ market valuations are similar to CLDR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SFBS | 11 | 10362 | 3 |

| DY | 18 | 125784 | -5 |

| KBH | 14 | 274581 | -3 |

| CRS | 15 | 87982 | 1 |

| Average | 14.5 | 124677 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $125 million. That figure was $133 million in CLDR’s case. Dycom Industries, Inc. (NYSE:DY) is the most popular stock in this table. On the other hand ServisFirst Bancshares, Inc. (NASDAQ:SFBS) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Cloudera, Inc. (NYSE:CLDR) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CLDR wasn’t nearly as popular as these 15 stock and hedge funds that were betting on CLDR were disappointed as the stock returned -2.3% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.