The first quarter was a breeze as Powell pivoted, and China seemed eager to reach a deal with Trump. Both the S&P 500 and Russell 2000 delivered very strong gains as a result, with the Russell 2000, which is composed of smaller companies, outperforming the large-cap stocks slightly during the first quarter. Unfortunately sentiment shifted in May and August as this time China pivoted and Trump put more pressure on China by increasing tariffs. Hedge funds’ top 20 stock picks performed spectacularly in this volatile environment. These stocks delivered a total gain of 24.4% through September 30th, vs. a gain of 20.4% for the S&P 500 ETF. In this article we will look at how this market volatility affected the sentiment of hedge funds towards Ciena Corporation (NASDAQ:CIEN), and what that likely means for the prospects of the company and its stock.

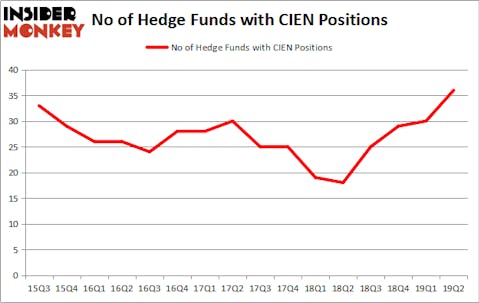

Is Ciena Corporation (NASDAQ:CIEN) a buy, sell, or hold? Hedge funds are becoming hopeful. The number of long hedge fund positions inched up by 6 lately. Our calculations also showed that CIEN isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s view the fresh hedge fund action encompassing Ciena Corporation (NASDAQ:CIEN).

What does smart money think about Ciena Corporation (NASDAQ:CIEN)?

At Q2’s end, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 20% from one quarter earlier. On the other hand, there were a total of 18 hedge funds with a bullish position in CIEN a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

More specifically, AQR Capital Management was the largest shareholder of Ciena Corporation (NASDAQ:CIEN), with a stake worth $127.9 million reported as of the end of March. Trailing AQR Capital Management was D E Shaw, which amassed a stake valued at $73.6 million. Arrowstreet Capital, Holocene Advisors, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, some big names have been driving this bullishness. Holocene Advisors, managed by Brandon Haley, initiated the most valuable position in Ciena Corporation (NASDAQ:CIEN). Holocene Advisors had $53.4 million invested in the company at the end of the quarter. Marcelo Desio’s Lucha Capital Management also initiated a $16.9 million position during the quarter. The following funds were also among the new CIEN investors: David Harding’s Winton Capital Management, Will Graves’s Boardman Bay Capital Management, and Louis Navellier’s Navellier & Associates.

Let’s go over hedge fund activity in other stocks similar to Ciena Corporation (NASDAQ:CIEN). These stocks are Macy’s, Inc. (NYSE:M), Herbalife Nutrition Ltd. (NYSE:HLF), American Campus Communities, Inc. (NYSE:ACC), and Pentair plc (NYSE:PNR). This group of stocks’ market valuations match CIEN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| M | 31 | 545279 | 1 |

| HLF | 27 | 2752898 | -5 |

| ACC | 17 | 373471 | -2 |

| PNR | 21 | 546471 | -7 |

| Average | 24 | 1054530 | -3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $1055 million. That figure was $555 million in CIEN’s case. Macy’s, Inc. (NYSE:M) is the most popular stock in this table. On the other hand American Campus Communities, Inc. (NYSE:ACC) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Ciena Corporation (NASDAQ:CIEN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CIEN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CIEN were disappointed as the stock returned -4.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.