“Since 2006, value stocks (IVE vs IVW) have underperformed 11 of the 13 calendar years and when they beat growth, it wasn’t by much. Cumulatively, through this week, it has been a 122% differential (up 52% for value vs up 174% for growth). This appears to be the longest and most severe drought for value investors since data collection began. It will go our way eventually as there are too many people paying far too much for today’s darlings, both public and private. Further, the ten-year yield of 2.5% (pre-tax) isn’t attractive nor is real estate. We believe the value part of the global equity market is the only place to earn solid risk adjusted returns and we believe those returns will be higher than normal,” said Vilas Fund in its Q1 investor letter. We aren’t sure whether value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Celsius Holdings, Inc. (NASDAQ:CELH).

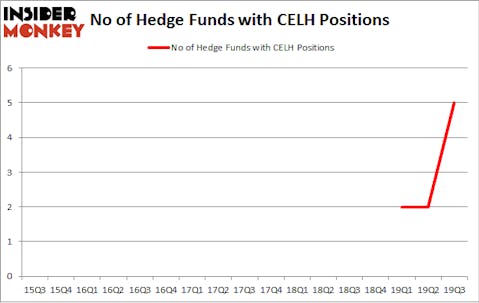

Is Celsius Holdings, Inc. (NASDAQ:CELH) ready to rally soon? The smart money is in a bullish mood. The number of bullish hedge fund bets improved by 3 lately. Our calculations also showed that CELH isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). CELH was in 5 hedge funds’ portfolios at the end of September. There were 2 hedge funds in our database with CELH holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are plenty of methods stock traders employ to appraise stocks. Some of the less known methods are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the top money managers can outclass their index-focused peers by a healthy margin (see the details here).

Philip Hempleman of Ardsley Partners

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Now let’s go over the recent hedge fund action regarding Celsius Holdings, Inc. (NASDAQ:CELH).

How are hedge funds trading Celsius Holdings, Inc. (NASDAQ:CELH)?

Heading into the fourth quarter of 2019, a total of 5 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 150% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CELH over the last 17 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Celsius Holdings, Inc. (NASDAQ:CELH) was held by Ardsley Partners, which reported holding $0.5 million worth of stock at the end of September. It was followed by Springbok Capital with a $0.1 million position. Other investors bullish on the company included Fondren Management, Millennium Management, and GAMCO Investors. In terms of the portfolio weights assigned to each position Ardsley Partners allocated the biggest weight to Celsius Holdings, Inc. (NASDAQ:CELH), around 0.12% of its 13F portfolio. Fondren Management is also relatively very bullish on the stock, designating 0.06 percent of its 13F equity portfolio to CELH.

As aggregate interest increased, key money managers have jumped into Celsius Holdings, Inc. (NASDAQ:CELH) headfirst. Ardsley Partners, managed by Philip Hempleman, established the biggest position in Celsius Holdings, Inc. (NASDAQ:CELH). Ardsley Partners had $0.5 million invested in the company at the end of the quarter. Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital also made a $0.1 million investment in the stock during the quarter. The other funds with brand new CELH positions are Bradley Louis Radoff’s Fondren Management and Israel Englander’s Millennium Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Celsius Holdings, Inc. (NASDAQ:CELH) but similarly valued. These stocks are Century Casinos, Inc. (NASDAQ:CNTY), The Habit Restaurants Inc (NASDAQ:HABT), CIM Commercial Trust Corporation (NASDAQ:CMCT), and Weyco Group, Inc. (NASDAQ:WEYS). This group of stocks’ market values are closest to CELH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNTY | 13 | 51313 | 3 |

| HABT | 13 | 38775 | 1 |

| CMCT | 2 | 579 | 1 |

| WEYS | 3 | 9345 | 0 |

| Average | 7.75 | 25003 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.75 hedge funds with bullish positions and the average amount invested in these stocks was $25 million. That figure was $1 million in CELH’s case. Century Casinos, Inc. (NASDAQ:CNTY) is the most popular stock in this table. On the other hand CIM Commercial Trust Corporation (NASDAQ:CMCT) is the least popular one with only 2 bullish hedge fund positions. Celsius Holdings, Inc. (NASDAQ:CELH) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on CELH as the stock returned 39.4% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.