Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of December. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is CareTrust REIT, Inc. (NASDAQ:CTRE), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

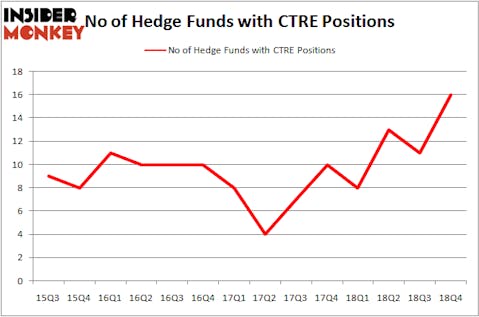

Is CareTrust REIT, Inc. (NASDAQ:CTRE) a bargain? Money managers are getting more optimistic. The number of bullish hedge fund positions moved up by 5 lately. Our calculations also showed that CTRE isn’t among the 30 most popular stocks among hedge funds. CTRE was in 16 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 11 hedge funds in our database with CTRE positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s go over the recent hedge fund action surrounding CareTrust REIT, Inc. (NASDAQ:CTRE).

How are hedge funds trading CareTrust REIT, Inc. (NASDAQ:CTRE)?

Heading into the first quarter of 2019, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 45% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CTRE over the last 14 quarters. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Israel Englander’s Millennium Management has the biggest position in CareTrust REIT, Inc. (NASDAQ:CTRE), worth close to $37 million, accounting for 0.1% of its total 13F portfolio. The second largest stake is held by Carlson Capital, led by Clint Carlson, holding a $32.7 million position; 0.5% of its 13F portfolio is allocated to the stock. Other members of the smart money with similar optimism encompass Jim Simons’s Renaissance Technologies, John Overdeck and David Siegel’s Two Sigma Advisors and D. E. Shaw’s D E Shaw.

As industrywide interest jumped, some big names have jumped into CareTrust REIT, Inc. (NASDAQ:CTRE) headfirst. HBK Investments, managed by David Costen Haley, established the biggest position in CareTrust REIT, Inc. (NASDAQ:CTRE). HBK Investments had $1 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $0.6 million investment in the stock during the quarter. The other funds with brand new CTRE positions are Benjamin A. Smith’s Laurion Capital Management and Minhua Zhang’s Weld Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to CareTrust REIT, Inc. (NASDAQ:CTRE). We will take a look at The Simply Good Foods Company (NASDAQ:SMPL), Tower Semiconductor Ltd. (NASDAQ:TSEM), Corcept Therapeutics Incorporated (NASDAQ:CORT), and CVR Refining LP (NYSE:CVRR). This group of stocks’ market caps are closest to CTRE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SMPL | 25 | 184420 | 2 |

| TSEM | 16 | 222231 | 3 |

| CORT | 19 | 189942 | 4 |

| CVRR | 7 | 73753 | 5 |

| Average | 16.75 | 167587 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $168 million. That figure was $126 million in CTRE’s case. The Simply Good Foods Company (NASDAQ:SMPL) is the most popular stock in this table. On the other hand CVR Refining LP (NYSE:CVRR) is the least popular one with only 7 bullish hedge fund positions. CareTrust REIT, Inc. (NASDAQ:CTRE) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on CTRE as the stock returned 26.6% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.