Is Cardlytics, Inc. (NASDAQ:CDLX) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

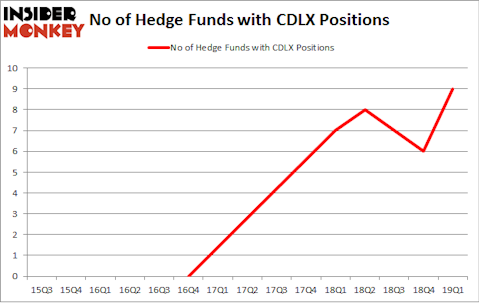

Cardlytics, Inc. (NASDAQ:CDLX) was in 9 hedge funds’ portfolios at the end of March. CDLX has seen an increase in activity from the world’s largest hedge funds in recent months. There were 6 hedge funds in our database with CDLX positions at the end of the previous quarter. Our calculations also showed that cdlx isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a look at the recent hedge fund action encompassing Cardlytics, Inc. (NASDAQ:CDLX).

Hedge fund activity in Cardlytics, Inc. (NASDAQ:CDLX)

At Q1’s end, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 50% from the previous quarter. On the other hand, there were a total of 7 hedge funds with a bullish position in CDLX a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Cardlytics, Inc. (NASDAQ:CDLX) was held by Cannell Capital, which reported holding $10.4 million worth of stock at the end of March. It was followed by Shannon River Fund Management with a $5.2 million position. Other investors bullish on the company included Hudson Bay Capital Management, G2 Investment Partners Management, and Springbok Capital.

As one would reasonably expect, specific money managers have jumped into Cardlytics, Inc. (NASDAQ:CDLX) headfirst. Hudson Bay Capital Management, managed by Sander Gerber, created the most outsized position in Cardlytics, Inc. (NASDAQ:CDLX). Hudson Bay Capital Management had $4.1 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $0.3 million position during the quarter. The other funds with brand new CDLX positions are Mario Gabelli’s GAMCO Investors and Michael Gelband’s ExodusPoint Capital.

Let’s go over hedge fund activity in other stocks similar to Cardlytics, Inc. (NASDAQ:CDLX). These stocks are Zix Corporation (NASDAQ:ZIXI), American Software, Inc. (NASDAQ:AMSWA), Sierra Bancorp (NASDAQ:BSRR), and Ring Energy Inc (NYSE:REI). This group of stocks’ market valuations are similar to CDLX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZIXI | 21 | 70511 | 8 |

| AMSWA | 11 | 36281 | 3 |

| BSRR | 6 | 15012 | -1 |

| REI | 13 | 32879 | 5 |

| Average | 12.75 | 38671 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $39 million. That figure was $26 million in CDLX’s case. Zix Corporation (NASDAQ:ZIXI) is the most popular stock in this table. On the other hand Sierra Bancorp (NASDAQ:BSRR) is the least popular one with only 6 bullish hedge fund positions. Cardlytics, Inc. (NASDAQ:CDLX) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on CDLX as the stock returned 47.8% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.