At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (see why hell is coming). We reversed our stance on March 25th after seeing unprecedented fiscal and monetary stimulus unleashed by the Fed and the Congress. This is the perfect market for stock pickers, now that the stocks are fully valued again. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Cardinal Health, Inc. (NYSE:CAH) at the end of the second quarter and determine whether the smart money was really smart about this stock.

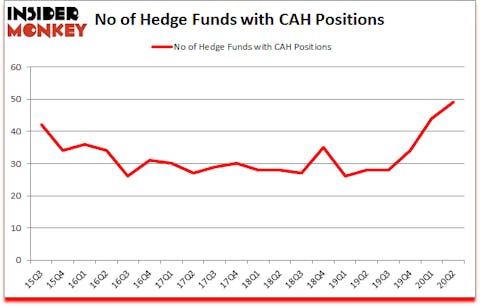

Cardinal Health, Inc. (NYSE:CAH) investors should pay attention to an increase in activity from the world’s largest hedge funds of late. Cardinal Health, Inc. (NYSE:CAH) was in 49 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 42. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 44 hedge funds in our database with CAH positions at the end of the first quarter. Our calculations also showed that CAH isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 56 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 34% through August 17th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Joel Greenblatt of Gotham Asset Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost precious metals prices. So, we are checking out this junior gold mining stock.. We go through lists like the 10 most profitable companies in America to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. Now let’s take a peek at the key hedge fund action regarding Cardinal Health, Inc. (NYSE:CAH).

Hedge fund activity in Cardinal Health, Inc. (NYSE:CAH)

At second quarter’s end, a total of 49 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 11% from the first quarter of 2020. Below, you can check out the change in hedge fund sentiment towards CAH over the last 20 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Pzena Investment Management, managed by Richard S. Pzena, holds the largest position in Cardinal Health, Inc. (NYSE:CAH). Pzena Investment Management has a $156.8 million position in the stock, comprising 1% of its 13F portfolio. Coming in second is AQR Capital Management, managed by Cliff Asness, which holds a $139.2 million position; 0.2% of its 13F portfolio is allocated to the stock. Some other professional money managers with similar optimism consist of Noam Gottesman’s GLG Partners, D. E. Shaw’s D E Shaw and Renaissance Technologies. In terms of the portfolio weights assigned to each position Healthcare Value Capital allocated the biggest weight to Cardinal Health, Inc. (NYSE:CAH), around 6.66% of its 13F portfolio. East Side Capital (RR Partners) is also relatively very bullish on the stock, setting aside 3.23 percent of its 13F equity portfolio to CAH.

Now, key money managers were breaking ground themselves. Gotham Asset Management, managed by Joel Greenblatt, established the most valuable position in Cardinal Health, Inc. (NYSE:CAH). Gotham Asset Management had $7.5 million invested in the company at the end of the quarter. Michael Castor’s Sio Capital also initiated a $7 million position during the quarter. The other funds with new positions in the stock are Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management, Kerr Neilson’s Platinum Asset Management, and Minhua Zhang’s Weld Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Cardinal Health, Inc. (NYSE:CAH). We will take a look at Tractor Supply Company (NASDAQ:TSCO), CBRE Group, Inc. (NYSE:CBRE), BioNTech SE (NASDAQ:BNTX), The Cooper Companies, Inc. (NYSE:COO), Warner Music Group Corp. (NASDAQ:WMG), Campbell Soup Company (NYSE:CPB), and Essex Property Trust Inc (NYSE:ESS). This group of stocks’ market valuations are similar to CAH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TSCO | 38 | 828499 | 1 |

| CBRE | 29 | 1442786 | -4 |

| BNTX | 15 | 367554 | 9 |

| COO | 34 | 876136 | 9 |

| WMG | 31 | 592226 | 31 |

| CPB | 32 | 450053 | -8 |

| ESS | 28 | 551715 | -3 |

| Average | 29.6 | 729853 | 5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.6 hedge funds with bullish positions and the average amount invested in these stocks was $730 million. That figure was $957 million in CAH’s case. Tractor Supply Company (NASDAQ:TSCO) is the most popular stock in this table. On the other hand BioNTech SE (NASDAQ:BNTX) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Cardinal Health, Inc. (NYSE:CAH) is more popular among hedge funds. Our overall hedge fund sentiment score for CAH is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 33% in 2020 through the end of August and still beat the market by 23.2 percentage points. Unfortunately CAH wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on CAH were disappointed as the stock returned -2.7% since the end of the second quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Cardinal Health Inc (NYSE:CAH)

Follow Cardinal Health Inc (NYSE:CAH)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.