We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Clarivate Analytics (NYSE:CCC).

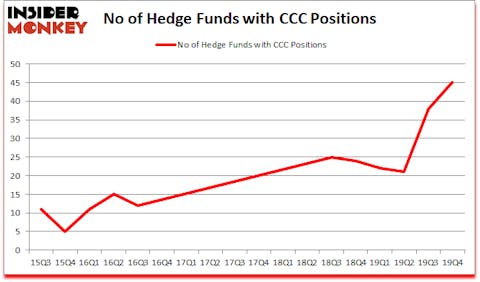

Is Clarivate Analytics Plc (NYSE:CCC) ready to rally soon? Prominent investors are getting more bullish. The number of long hedge fund bets rose by 7 in recent months. Our calculations also showed that CCC isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Daniel Sundheim of D1 Capital Partners

Now we’re going to check out the key hedge fund action regarding Clarivate Analytics.

How have hedgies been trading Clarivate Analytics?

At Q4’s end, a total of 45 of the hedge funds tracked by Insider Monkey were long this stock, a change of 18% from the third quarter of 2019. On the other hand, there were a total of 24 hedge funds with a bullish position in CCC a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Select Equity Group, managed by Robert Joseph Caruso, holds the most valuable position in Clarivate Analytics. Select Equity Group has a $149.3 million position in the stock, comprising 0.9% of its 13F portfolio. On Select Equity Group’s heels is D1 Capital Partners, led by Daniel Sundheim, holding a $127.7 million position; the fund has 1.9% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish include Mitch Kuflik and Rob Sobel’s Brahman Capital, Jonathan Soros’s JS Capital and Ben Gambill’s Tiger Eye Capital. In terms of the portfolio weights assigned to each position Ratan Capital Group allocated the biggest weight to Clarivate Analytics (NYSE:CCC), around 16.54% of its 13F portfolio. Antipodean Advisors is also relatively very bullish on the stock, dishing out 12.25 percent of its 13F equity portfolio to CCC.

As industrywide interest jumped, specific money managers have been driving this bullishness. 40 North Management, managed by David S. Winter and David J. Millstone, assembled the biggest position in Clarivate Analytics (NYSE:CCC). 40 North Management had $18 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also made a $8.3 million investment in the stock during the quarter. The other funds with brand new CCC positions are Josh Donfeld and David Rogers’s Castle Hook Partners, Matthew L Pinz’s Pinz Capital, and David Costen Haley’s HBK Investments.

Let’s go over hedge fund activity in other stocks similar to Clarivate Analytics. We will take a look at Floor & Decor Holdings, Inc. (NYSE:FND), Cloudflare, Inc. (NYSE:NET), Essent Group Ltd (NYSE:ESNT), and Hawaiian Electric Industries, Inc. (NYSE:HE). This group of stocks’ market values are similar to CCC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FND | 27 | 547579 | 3 |

| NET | 22 | 205121 | -11 |

| ESNT | 36 | 327183 | 12 |

| HE | 17 | 175734 | 3 |

| Average | 25.5 | 313904 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $314 million. That figure was $813 million in CCC’s case. Essent Group Ltd (NYSE:ESNT) is the most popular stock in this table. On the other hand Hawaiian Electric Industries, Inc. (NYSE:HE) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Clarivate Analytics is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 17.4% in 2020 through March 25th but still managed to beat the market by 5.5 percentage points. Hedge funds were also right about betting on CCC as the stock returned 23.9% so far in Q1 (through March 25th) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.