Is BT Group plc (NYSE:BT) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

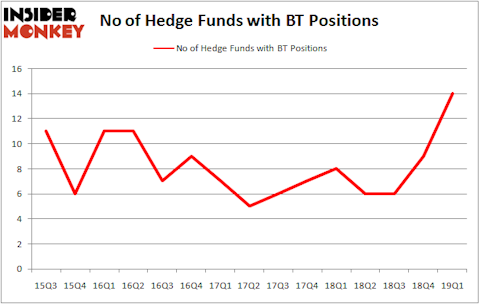

BT Group plc (NYSE:BT) investors should be aware of an increase in enthusiasm from smart money of late. BT was in 14 hedge funds’ portfolios at the end of the first quarter of 2019. There were 9 hedge funds in our database with BT holdings at the end of the previous quarter. Our calculations also showed that BT isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Michael Platt of Bluecrest Capital Management

Let’s take a look at the fresh hedge fund action surrounding BT Group plc (NYSE:BT).

Hedge fund activity in BT Group plc (NYSE:BT)

Heading into the second quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 56% from the previous quarter. The graph below displays the number of hedge funds with bullish position in BT over the last 15 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Simons’s Renaissance Technologies has the largest position in BT Group plc (NYSE:BT), worth close to $17.1 million, amounting to less than 0.1%% of its total 13F portfolio. Sitting at the No. 2 spot is Ken Griffin of Citadel Investment Group, with a $13.6 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Remaining professional money managers with similar optimism consist of Steve Cohen’s Point72 Asset Management, Minhua Zhang’s Weld Capital Management and Israel Englander’s Millennium Management.

As aggregate interest increased, specific money managers have jumped into BT Group plc (NYSE:BT) headfirst. Weld Capital Management, managed by Minhua Zhang, assembled the most valuable position in BT Group plc (NYSE:BT). Weld Capital Management had $1.7 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also made a $1 million investment in the stock during the quarter. The other funds with new positions in the stock are Michael Gelband’s ExodusPoint Capital, Mike Vranos’s Ellington, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as BT Group plc (NYSE:BT) but similarly valued. We will take a look at Xcel Energy Inc (NASDAQ:XEL), Canadian Pacific Railway Limited (NYSE:CP), Paychex, Inc. (NASDAQ:PAYX), and ONEOK, Inc. (NYSE:OKE). This group of stocks’ market caps are similar to BT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XEL | 16 | 527326 | -5 |

| CP | 30 | 1974726 | -10 |

| PAYX | 21 | 808401 | -9 |

| OKE | 14 | 278924 | -12 |

| Average | 20.25 | 897344 | -9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.25 hedge funds with bullish positions and the average amount invested in these stocks was $897 million. That figure was $39 million in BT’s case. Canadian Pacific Railway Limited (NYSE:CP) is the most popular stock in this table. On the other hand ONEOK, Inc. (NYSE:OKE) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks BT Group plc (NYSE:BT) is even less popular than OKE. Hedge funds dodged a bullet by taking a bearish stance towards BT. Our calculations showed that the top 20 most popular hedge fund stocks returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately BT wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); BT investors were disappointed as the stock returned -10% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.