Hedge fund managers like David Einhorn, Bill Ackman, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Braemar Hotels & Resorts Inc. (NYSE:BHR).

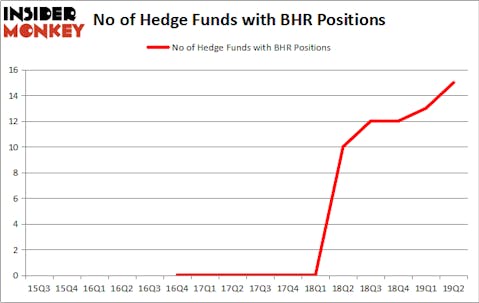

Braemar Hotels & Resorts Inc. (NYSE:BHR) was in 15 hedge funds’ portfolios at the end of the second quarter of 2019. BHR has experienced an increase in support from the world’s most elite money managers recently. There were 13 hedge funds in our database with BHR positions at the end of the previous quarter. Our calculations also showed that BHR isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most stock holders, hedge funds are perceived as worthless, old investment vehicles of the past. While there are more than 8000 funds trading at present, Our researchers hone in on the top tier of this group, about 750 funds. It is estimated that this group of investors preside over bulk of the hedge fund industry’s total asset base, and by watching their best equity investments, Insider Monkey has revealed a number of investment strategies that have historically outperformed Mr. Market. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. We’re going to take a gander at the recent hedge fund action encompassing Braemar Hotels & Resorts Inc. (NYSE:BHR).

How are hedge funds trading Braemar Hotels & Resorts Inc. (NYSE:BHR)?

At Q2’s end, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 15% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards BHR over the last 16 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, James Dondero’s Highland Capital Management has the most valuable position in Braemar Hotels & Resorts Inc. (NYSE:BHR), worth close to $27.9 million, accounting for 1.6% of its total 13F portfolio. Coming in second is Forward Management, led by J. Alan Reid, Jr., holding a $14.5 million position; 2.6% of its 13F portfolio is allocated to the stock. Remaining peers that are bullish encompass Renaissance Technologies, Cliff Asness’s AQR Capital Management and John Petry’s Sessa Capital.

As aggregate interest increased, key money managers have been driving this bullishness. Tudor Investment Corp, managed by Paul Tudor Jones, created the largest position in Braemar Hotels & Resorts Inc. (NYSE:BHR). Tudor Investment Corp had $0.4 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also made a $0.2 million investment in the stock during the quarter. The following funds were also among the new BHR investors: David Harding’s Winton Capital Management, D. E. Shaw’s D E Shaw, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Braemar Hotels & Resorts Inc. (NYSE:BHR) but similarly valued. We will take a look at StarTek, Inc. (NYSE:SRT), Investors Title Company (NASDAQ:ITIC), Yintech Investment Holdings Limited (NASDAQ:YIN), and BioLife Solutions, Inc. (NASDAQ:BLFS). This group of stocks’ market values resemble BHR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SRT | 3 | 8110 | -4 |

| ITIC | 3 | 39506 | -1 |

| YIN | 1 | 264 | -1 |

| BLFS | 13 | 76163 | -2 |

| Average | 5 | 31011 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5 hedge funds with bullish positions and the average amount invested in these stocks was $31 million. That figure was $59 million in BHR’s case. BioLife Solutions, Inc. (NASDAQ:BLFS) is the most popular stock in this table. On the other hand Yintech Investment Holdings Limited (NASDAQ:YIN) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Braemar Hotels & Resorts Inc. (NYSE:BHR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately BHR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BHR were disappointed as the stock returned -3.5% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.