There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Jeff Ubben, George Soros and Carl Icahn think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Boston Scientific Corporation (NYSE:BSX).

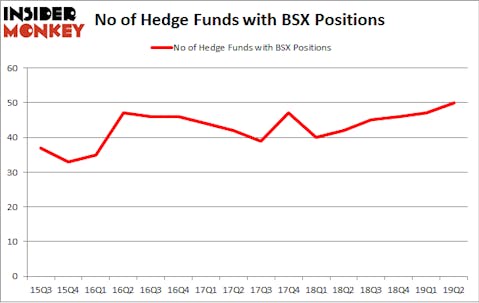

Is Boston Scientific Corporation (NYSE:BSX) the right pick for your portfolio? Money managers are in a bullish mood. The number of long hedge fund positions increased by 3 recently. Our calculations also showed that BSX isn’t among the 30 most popular stocks among hedge funds.

According to most traders, hedge funds are seen as worthless, outdated investment tools of years past. While there are more than 8000 funds in operation at the moment, Our researchers look at the masters of this club, approximately 750 funds. These investment experts handle the majority of the hedge fund industry’s total capital, and by following their unrivaled equity investments, Insider Monkey has formulated several investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to analyze the new hedge fund action encompassing Boston Scientific Corporation (NYSE:BSX).

What have hedge funds been doing with Boston Scientific Corporation (NYSE:BSX)?

Heading into the third quarter of 2019, a total of 50 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from the first quarter of 2019. By comparison, 42 hedge funds held shares or bullish call options in BSX a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Marshall Wace LLP held the most valuable stake in Boston Scientific Corporation (NYSE:BSX), which was worth $410.3 million at the end of the second quarter. On the second spot was Viking Global which amassed $395.2 million worth of shares. Moreover, OrbiMed Advisors, Citadel Investment Group, and Third Point were also bullish on Boston Scientific Corporation (NYSE:BSX), allocating a large percentage of their portfolios to this stock.

Now, some big names have jumped into Boston Scientific Corporation (NYSE:BSX) headfirst. Eminence Capital, managed by Ricky Sandler, established the largest position in Boston Scientific Corporation (NYSE:BSX). Eminence Capital had $141.5 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also made a $41.7 million investment in the stock during the quarter. The following funds were also among the new BSX investors: Sander Gerber’s Hudson Bay Capital Management, Brandon Haley’s Holocene Advisors, and Per Johanssoná’s Bodenholm Capital.

Let’s go over hedge fund activity in other stocks similar to Boston Scientific Corporation (NYSE:BSX). These stocks are Eni SpA (NYSE:E), The Southern Company (NYSE:SO), S&P Global Inc. (NYSE:SPGI), and Prudential plc (NYSE:PUK). All of these stocks’ market caps match BSX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| E | 5 | 79240 | -4 |

| SO | 22 | 835876 | 3 |

| SPGI | 58 | 4351436 | 4 |

| PUK | 5 | 40016 | -1 |

| Average | 22.5 | 1326642 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $1327 million. That figure was $2981 million in BSX’s case. S&P Global Inc. (NYSE:SPGI) is the most popular stock in this table. On the other hand Eni SpA (NYSE:E) is the least popular one with only 5 bullish hedge fund positions. Boston Scientific Corporation (NYSE:BSX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately BSX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BSX were disappointed as the stock returned -5.3% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.