At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

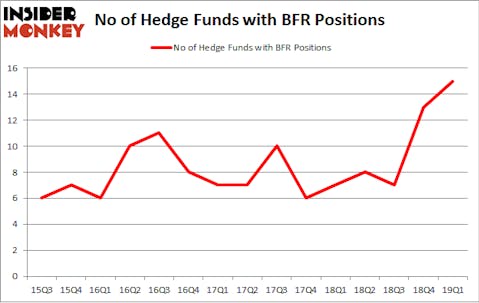

BBVA Banco Frances S.A. (NYSE:BFR) was in 15 hedge funds’ portfolios at the end of the first quarter of 2019. BFR investors should pay attention to an increase in hedge fund interest in recent months. There were 13 hedge funds in our database with BFR positions at the end of the previous quarter. Our calculations also showed that bfr isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the new hedge fund action regarding BBVA Banco Frances S.A. (NYSE:BFR).

How are hedge funds trading BBVA Banco Frances S.A. (NYSE:BFR)?

At the end of the first quarter, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 15% from the fourth quarter of 2018. By comparison, 7 hedge funds held shares or bullish call options in BFR a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in BBVA Banco Frances S.A. (NYSE:BFR), which was worth $8.5 million at the end of the first quarter. On the second spot was Horseman Capital Management which amassed $8 million worth of shares. Moreover, EMS Capital, LMR Partners, and D E Shaw were also bullish on BBVA Banco Frances S.A. (NYSE:BFR), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key hedge funds have been driving this bullishness. D E Shaw, managed by D. E. Shaw, created the most valuable position in BBVA Banco Frances S.A. (NYSE:BFR). D E Shaw had $2 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $0.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Michael Gelband’s ExodusPoint Capital, Michael Platt and William Reeves’s BlueCrest Capital Mgmt., and Jonathan Soros’s JS Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as BBVA Banco Frances S.A. (NYSE:BFR) but similarly valued. These stocks are World Fuel Services Corporation (NYSE:INT), GTT Communications Inc (NYSE:GTT), Artisan Partners Asset Management Inc (NYSE:APAM), and NeoGenomics, Inc. (NASDAQ:NEO). All of these stocks’ market caps resemble BFR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INT | 18 | 118572 | -6 |

| GTT | 18 | 547225 | 3 |

| APAM | 16 | 168247 | 0 |

| NEO | 15 | 50733 | -9 |

| Average | 16.75 | 221194 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $221 million. That figure was $29 million in BFR’s case. World Fuel Services Corporation (NYSE:INT) is the most popular stock in this table. On the other hand NeoGenomics, Inc. (NASDAQ:NEO) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks BBVA Banco Frances S.A. (NYSE:BFR) is even less popular than NEO. Hedge funds clearly dropped the ball on BFR as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on BFR as the stock returned 22.3% during the same period and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.