The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their March 31 holdings, data that is available nowhere else. Should you consider Barnes Group Inc. (NYSE:B) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

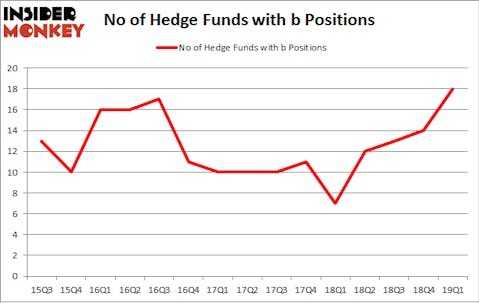

Is Barnes Group Inc. (NYSE:B) a buy right now? Investors who are in the know are in a bullish mood. The number of bullish hedge fund positions went up by 4 in recent months. Our calculations also showed that b isn’t among the 30 most popular stocks among hedge funds. B was in 18 hedge funds’ portfolios at the end of March. There were 14 hedge funds in our database with B holdings at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Noam Gottesman, GLG Partners

We’re going to take a peek at the new hedge fund action encompassing Barnes Group Inc. (NYSE:B).

What does the smart money think about Barnes Group Inc. (NYSE:B)?

At Q1’s end, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 29% from the fourth quarter of 2018. By comparison, 7 hedge funds held shares or bullish call options in B a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

The largest stake in Barnes Group Inc. (NYSE:B) was held by GLG Partners, which reported holding $8.8 million worth of stock at the end of March. It was followed by Millennium Management with a $6 million position. Other investors bullish on the company included Renaissance Technologies, D E Shaw, and Fisher Asset Management.

As one would reasonably expect, key hedge funds have been driving this bullishness. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, established the biggest position in Barnes Group Inc. (NYSE:B). Arrowstreet Capital had $3.3 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also made a $0.9 million investment in the stock during the quarter. The following funds were also among the new B investors: Bruce Kovner’s Caxton Associates LP, Paul Tudor Jones’s Tudor Investment Corp, and Minhua Zhang’s Weld Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Barnes Group Inc. (NYSE:B) but similarly valued. We will take a look at Rexnord Corp (NYSE:RXN), Columbia Property Trust Inc (NYSE:CXP), Fulton Financial Corp (NASDAQ:FULT), and American States Water Co (NYSE:AWR). All of these stocks’ market caps match B’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RXN | 21 | 171232 | 2 |

| CXP | 15 | 83003 | 2 |

| FULT | 16 | 20134 | 4 |

| AWR | 15 | 70324 | 3 |

| Average | 16.75 | 86173 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $86 million. That figure was $44 million in B’s case. Rexnord Corp (NYSE:RXN) is the most popular stock in this table. On the other hand Columbia Property Trust Inc (NYSE:CXP) is the least popular one with only 15 bullish hedge fund positions. Barnes Group Inc. (NYSE:B) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on B as the stock returned 2.6% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.