The elite funds run by legendary investors such as David Tepper and Dan Loeb make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentives to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Audentes Therapeutics, Inc. (NASDAQ:BOLD) from the perspective of those elite funds.

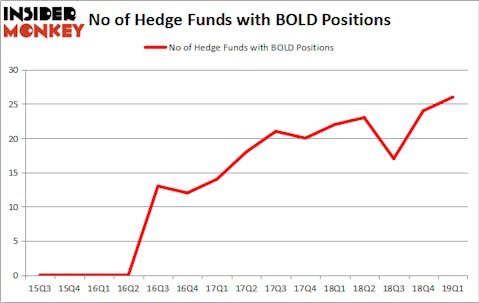

Is Audentes Therapeutics, Inc. (NASDAQ:BOLD) a safe investment now? Investors who are in the know are betting on the stock. The number of long hedge fund positions went up by 2 in recent months. Our calculations also showed that BOLD isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to go over the latest hedge fund action regarding Audentes Therapeutics, Inc. (NASDAQ:BOLD).

How have hedgies been trading Audentes Therapeutics, Inc. (NASDAQ:BOLD)?

At Q1’s end, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards BOLD over the last 15 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

The largest stake in Audentes Therapeutics, Inc. (NASDAQ:BOLD) was held by Redmile Group, which reported holding $106.7 million worth of stock at the end of March. It was followed by Partner Fund Management with a $79.2 million position. Other investors bullish on the company included OrbiMed Advisors, Baker Bros. Advisors, and Great Point Partners.

As one would reasonably expect, some big names have been driving this bullishness. Adage Capital Management, managed by Phill Gross and Robert Atchinson, initiated the most outsized position in Audentes Therapeutics, Inc. (NASDAQ:BOLD). Adage Capital Management had $6.5 million invested in the company at the end of the quarter. Michael S. Weiss and Lindsay A. Rosenwald’s Opus Point Partners Management also made a $0.7 million investment in the stock during the quarter. The other funds with brand new BOLD positions are Minhua Zhang’s Weld Capital Management and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Audentes Therapeutics, Inc. (NASDAQ:BOLD) but similarly valued. We will take a look at BancFirst Corporation (NASDAQ:BANF), Steelcase Inc. (NYSE:SCS), Meritor Inc (NYSE:MTOR), and The E.W. Scripps Company (NYSE:SSP). This group of stocks’ market valuations resemble BOLD’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BANF | 11 | 46268 | 2 |

| SCS | 24 | 57456 | 2 |

| MTOR | 18 | 295077 | -2 |

| SSP | 25 | 228660 | 11 |

| Average | 19.5 | 156865 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.5 hedge funds with bullish positions and the average amount invested in these stocks was $157 million. That figure was $598 million in BOLD’s case. The E.W. Scripps Company (NYSE:SSP) is the most popular stock in this table. On the other hand BancFirst Corporation (NASDAQ:BANF) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Audentes Therapeutics, Inc. (NASDAQ:BOLD) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately BOLD wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BOLD were disappointed as the stock returned -7.6% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.