At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

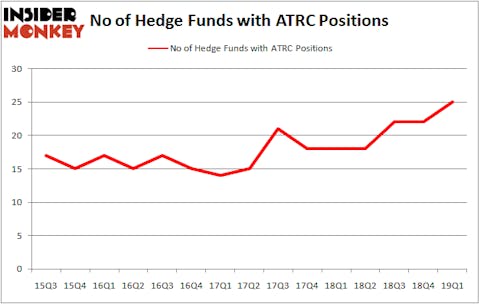

Is AtriCure Inc. (NASDAQ:ATRC) a buy right now? The smart money is in a bullish mood. The number of long hedge fund positions improved by 3 recently. Our calculations also showed that ATRC isn’t among the 30 most popular stocks among hedge funds. ATRC was in 25 hedge funds’ portfolios at the end of March. There were 22 hedge funds in our database with ATRC positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to review the latest hedge fund action encompassing AtriCure Inc. (NASDAQ:ATRC).

Hedge fund activity in AtriCure Inc. (NASDAQ:ATRC)

At the end of the first quarter, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ATRC over the last 15 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Israel Englander’s Millennium Management has the number one position in AtriCure Inc. (NASDAQ:ATRC), worth close to $16.6 million, amounting to less than 0.1%% of its total 13F portfolio. The second most bullish fund manager is Hudson Executive Capital, led by Douglas Braunstein and James Wooleryá, holding a $12 million position; 1.1% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that hold long positions encompass Justin John Ferayorni’s Tamarack Capital Management, Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management and Chuck Royce’s Royce & Associates.

As one would reasonably expect, specific money managers were leading the bulls’ herd. Endurant Capital Management, managed by Vishal Saluja and Pham Quang, established the most valuable position in AtriCure Inc. (NASDAQ:ATRC). Endurant Capital Management had $7.1 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $2.2 million investment in the stock during the quarter. The following funds were also among the new ATRC investors: Israel Englander’s Millennium Management, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Ken Griffin’s Citadel Investment Group.

Let’s now review hedge fund activity in other stocks similar to AtriCure Inc. (NASDAQ:ATRC). These stocks are Northern Oil & Gas, Inc. (NYSE:NOG), Despegar.com, Corp. (NYSE:DESP), Veracyte Inc (NASDAQ:VCYT), and Luminex Corporation (NASDAQ:LMNX). This group of stocks’ market valuations match ATRC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NOG | 20 | 141448 | 4 |

| DESP | 15 | 226527 | -4 |

| VCYT | 22 | 130377 | 5 |

| LMNX | 21 | 159503 | 2 |

| Average | 19.5 | 164464 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.5 hedge funds with bullish positions and the average amount invested in these stocks was $164 million. That figure was $123 million in ATRC’s case. Veracyte Inc (NASDAQ:VCYT) is the most popular stock in this table. On the other hand Despegar.com, Corp. (NYSE:DESP) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks AtriCure Inc. (NASDAQ:ATRC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on ATRC as the stock returned 11.8% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.