Is ASGN Incorporated (NYSE:ASGN) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

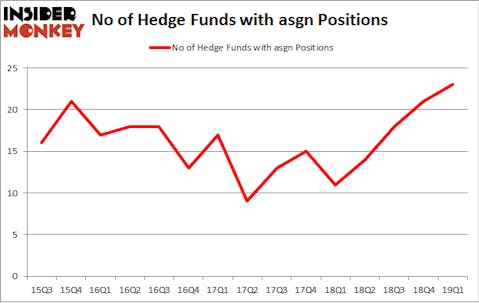

ASGN Incorporated (NYSE:ASGN) shareholders have witnessed an increase in support from the world’s most elite money managers recently. Our calculations also showed that asgn isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are viewed as worthless, old investment tools of years past. While there are more than 8000 funds in operation today, Our experts hone in on the aristocrats of this group, approximately 750 funds. It is estimated that this group of investors watch over the majority of the smart money’s total capital, and by keeping track of their finest investments, Insider Monkey has discovered a number of investment strategies that have historically defeated the market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Paul Marshall of Marshall Wace

Let’s take a glance at the key hedge fund action regarding ASGN Incorporated (NYSE:ASGN).

What have hedge funds been doing with ASGN Incorporated (NYSE:ASGN)?

At the end of the first quarter, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 10% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ASGN over the last 15 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

More specifically, Marshall Wace LLP was the largest shareholder of ASGN Incorporated (NYSE:ASGN), with a stake worth $38.4 million reported as of the end of March. Trailing Marshall Wace LLP was Citadel Investment Group, which amassed a stake valued at $29.5 million. Millennium Management, Select Equity Group, and Renaissance Technologies were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Select Equity Group, managed by Robert Joseph Caruso, assembled the most valuable position in ASGN Incorporated (NYSE:ASGN). Select Equity Group had $25.3 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also made a $0.8 million investment in the stock during the quarter. The other funds with new positions in the stock are John Overdeck and David Siegel’s Two Sigma Advisors, Hoon Kim’s Quantinno Capital, and Brandon Haley’s Holocene Advisors.

Let’s go over hedge fund activity in other stocks similar to ASGN Incorporated (NYSE:ASGN). These stocks are Turquoise Hill Resources Ltd (NYSE:TRQ), Lions Gate Entertainment Corporation (NYSE:LGF-B), Intercept Pharmaceuticals Inc (NASDAQ:ICPT), and The Timken Company (NYSE:TKR). This group of stocks’ market values match ASGN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TRQ | 17 | 928990 | 1 |

| LGF-B | 16 | 285528 | -3 |

| ICPT | 21 | 385810 | 0 |

| TKR | 26 | 288105 | 1 |

| Average | 20 | 472108 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $472 million. That figure was $172 million in ASGN’s case. The Timken Company (NYSE:TKR) is the most popular stock in this table. On the other hand Lions Gate Entertainment Corporation (NYSE:LGF-B) is the least popular one with only 16 bullish hedge fund positions. ASGN Incorporated (NYSE:ASGN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately ASGN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ASGN were disappointed as the stock returned -18.3% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.