At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

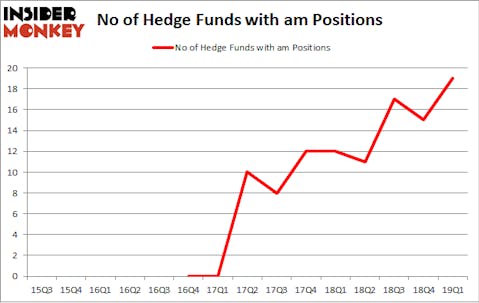

Antero Midstream Corp (NYSE:AM) has seen an increase in enthusiasm from smart money lately. AM was in 19 hedge funds’ portfolios at the end of March. There were 15 hedge funds in our database with AM positions at the end of the previous quarter. Our calculations also showed that am isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools stock market investors employ to appraise publicly traded companies. A duo of the best tools are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the best hedge fund managers can outpace the broader indices by a solid amount (see the details here).

Andrew Raab of FPR Partners

We’re going to take a peek at the latest hedge fund action encompassing Antero Midstream Corp (NYSE:AM).

How have hedgies been trading Antero Midstream Corp (NYSE:AM)?

Heading into the second quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 27% from one quarter earlier. By comparison, 12 hedge funds held shares or bullish call options in AM a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

More specifically, FPR Partners was the largest shareholder of Antero Midstream Corp (NYSE:AM), with a stake worth $105.3 million reported as of the end of March. Trailing FPR Partners was Zimmer Partners, which amassed a stake valued at $65.3 million. Millennium Management, Arrowstreet Capital, and Osterweis Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Now, specific money managers were breaking ground themselves. FPR Partners, managed by Bob Peck and Andy Raab, assembled the biggest position in Antero Midstream Corp (NYSE:AM). FPR Partners had $105.3 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $30.9 million investment in the stock during the quarter. The other funds with brand new AM positions are Alan Fournier’s Pennant Capital Management, Mitch Cantor’s Mountain Lake Investment Management, and Glenn Greenberg’s Brave Warrior Capital.

Let’s check out hedge fund activity in other stocks similar to Antero Midstream Corp (NYSE:AM). These stocks are GDS Holdings Limited (NASDAQ:GDS), Manpowergroup Inc (NYSE:MAN), Nexstar Media Group, Inc. (NASDAQ:NXST), and Genesee & Wyoming Inc (NYSE:GWR). This group of stocks’ market values are similar to AM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GDS | 33 | 846857 | 8 |

| MAN | 19 | 490554 | -6 |

| NXST | 31 | 1070646 | -3 |

| GWR | 22 | 409479 | 4 |

| Average | 26.25 | 704384 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.25 hedge funds with bullish positions and the average amount invested in these stocks was $704 million. That figure was $321 million in AM’s case. GDS Holdings Limited (NASDAQ:GDS) is the most popular stock in this table. On the other hand Manpowergroup Inc (NYSE:MAN) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks Antero Midstream Corp (NYSE:AM) is even less popular than MAN. Hedge funds dodged a bullet by taking a bearish stance towards AM. Our calculations showed that the top 15 most popular hedge fund stocks returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately AM wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); AM investors were disappointed as the stock returned -8.8% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.