Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Alphabet Inc (NASDAQ:GOOGL).

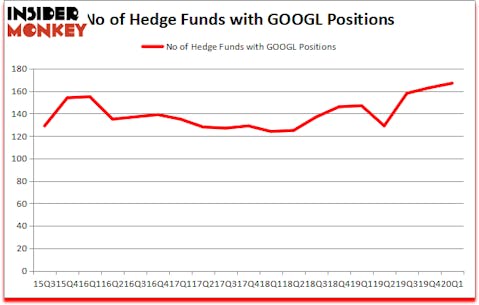

Is Alphabet Inc (NASDAQ:GOOGL) a buy right now? Prominent investors are becoming more confident. The number of long hedge fund positions moved up by 4 lately. Our calculations also showed that GOOGL ranked 5th among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). GOOGL was in 167 hedge funds’ portfolios at the end of March. There were 163 hedge funds in our database with GOOGL holdings at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 44 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 36% through May 18th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Eashwar Krishnan of Tybourne Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we asked astrophysicist Neil deGrasse Tyson about Tesla, Elon Musk, and his top stock picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s check out the key hedge fund action regarding Alphabet Inc (NASDAQ:GOOGL).

How have hedgies been trading Alphabet Inc (NASDAQ:GOOGL)?

At the end of the first quarter, a total of 167 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 2% from the previous quarter. On the other hand, there were a total of 147 hedge funds with a bullish position in GOOGL a year ago. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

The largest stake in Alphabet Inc (NASDAQ:GOOGL) was held by Fisher Asset Management, which reported holding $1736.5 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $1585.4 million position. Other investors bullish on the company included AQR Capital Management, Diamond Hill Capital, and Cantillon Capital Management. In terms of the portfolio weights assigned to each position Blacksheep Fund Management allocated the biggest weight to Alphabet Inc (NASDAQ:GOOGL), around 28.07% of its 13F portfolio. AltaRock Partners is also relatively very bullish on the stock, dishing out 21.47 percent of its 13F equity portfolio to GOOGL.

Now, some big names were breaking ground themselves. Tybourne Capital Management, managed by Eashwar Krishnan, established the most valuable position in Alphabet Inc (NASDAQ:GOOGL). Tybourne Capital Management had $86.2 million invested in the company at the end of the quarter. Chen Tianqiao’s Shanda Asset Management also initiated a $58.1 million position during the quarter. The other funds with new positions in the stock are Michael Larson’s Bill & Melinda Gates Foundation Trust, Brandon Haley’s Holocene Advisors, and Leon Shaulov’s Maplelane Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Alphabet Inc (NASDAQ:GOOGL). We will take a look at Alphabet Inc (NASDAQ:GOOG), Alibaba Group Holding Limited (NYSE:BABA), Facebook Inc (NASDAQ:FB), and Berkshire Hathaway Inc. (NYSE:BRK-B). All of these stocks’ market caps resemble GOOGL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GOOG | 147 | 15254756 | -1 |

| BABA | 167 | 19433098 | -3 |

| FB | 213 | 19600111 | 15 |

| BRK-B | 115 | 18119296 | 2 |

| Average | 160.5 | 18101815 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 160.5 hedge funds with bullish positions and the average amount invested in these stocks was $18102 million. That figure was $11083 million in GOOGL’s case. Facebook Inc (NASDAQ:FB) is the most popular stock in this table. On the other hand Berkshire Hathaway Inc. (NYSE:BRK-B) is the least popular one with only 115 bullish hedge fund positions. Alphabet Inc (NASDAQ:GOOGL) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 7.9% in 2020 through May 22nd but still beat the market by 15.6 percentage points. Hedge funds were also right about betting on GOOGL as the stock returned 21.6% in Q2 (through May 22nd) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.