Is Adobe Inc. (NASDAQ:ADBE) a good investment right now? We know coronavirus is probably the #1 concern in your mind right now. It should be. We estimate that COVID-19 will kill around 5 million people worldwide and there is actually a 3.3% probability that president Donald Trump will die from the new coronavirus (see the details). Coronavirus will probably cause a short recession and then things will get back to business as usual. That’s why we believe you should use this opportunity to identify the best stocks to invest for the future and add them to your portfolio at increasingly attractive prices. How do we find high quality stocks? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

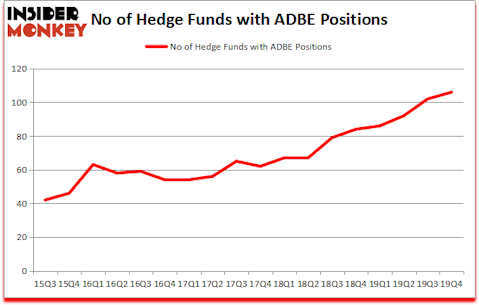

Is Adobe Inc. (NASDAQ:ADBE) the right pick for your portfolio? Investors who are in the know are getting more optimistic. The number of bullish hedge fund bets moved up by 4 lately. Our calculations also showed that ADBE currently ranks 16th among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

John Armitage of Egerton Capital

We leave no stone unturned when looking for the next great investment idea. For example this gold mining company is acquiring gold mines in Americas at a fraction of the cost of drilling them, so we look into its viability. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned nearly 50% despite the large losses in the market since our recommendation. Keeping this in mind let’s take a glance at the key hedge fund action regarding Adobe Inc. (NASDAQ:ADBE).

How have hedgies been trading Adobe Inc. (NASDAQ:ADBE)?

At the end of the foruth quarter, a total of 106 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 4% from the third quarter of 2019. By comparison, 84 hedge funds held shares or bullish call options in ADBE a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Fisher Asset Management was the largest shareholder of Adobe Inc. (NASDAQ:ADBE), with a stake worth $1361.5 million reported as of the end of September. Trailing Fisher Asset Management was Lone Pine Capital, which amassed a stake valued at $939.1 million. D E Shaw, Egerton Capital Limited, and Coatue Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position BlueSpruce Investments allocated the biggest weight to Adobe Inc. (NASDAQ:ADBE), around 12.92% of its 13F portfolio. Center Lake Capital is also relatively very bullish on the stock, setting aside 12.9 percent of its 13F equity portfolio to ADBE.

As aggregate interest increased, key hedge funds were breaking ground themselves. Balyasny Asset Management, managed by Dmitry Balyasny, established the most outsized position in Adobe Inc. (NASDAQ:ADBE). Balyasny Asset Management had $71.1 million invested in the company at the end of the quarter. James Crichton’s Hitchwood Capital Management also made a $66 million investment in the stock during the quarter. The other funds with new positions in the stock are Gregg Moskowitz’s Interval Partners, Adam Parker’s Center Lake Capital, and Robert Joseph Caruso’s Select Equity Group.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Adobe Inc. (NASDAQ:ADBE) but similarly valued. We will take a look at HSBC Holdings plc (NYSE:HSBC), NIKE, Inc. (NYSE:NKE), Abbott Laboratories (NYSE:ABT), and Medtronic plc (NYSE:MDT). This group of stocks’ market values are closest to ADBE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HSBC | 18 | 1118976 | 2 |

| NKE | 81 | 2510260 | 12 |

| ABT | 62 | 2055531 | -3 |

| MDT | 66 | 2500872 | 10 |

| Average | 56.75 | 2046410 | 5.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 56.75 hedge funds with bullish positions and the average amount invested in these stocks was $2046 million. That figure was $9784 million in ADBE’s case. NIKE, Inc. (NYSE:NKE) is the most popular stock in this table. On the other hand HSBC Holdings plc (NYSE:HSBC) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Adobe Inc. (NASDAQ:ADBE) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks also gained 0.1% in 2020 through March 2nd and beat the market by 4.1 percentage points. Hedge funds were also right about betting on ADBE as the stock returned 9.2% so far in Q1 (through March 2nd) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.