The market has been volatile in the last few months as the Federal Reserve finalized its rate cuts and uncertainty looms over trade negotiations with China. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points over the last 12 months. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, though some funds increased their exposure dramatically at the end of Q3 and the beginning of Q4. In this article, we analyze what the smart money thinks of Acasti Pharma Inc. (NASDAQ:ACST) and find out how it is affected by hedge funds’ moves.

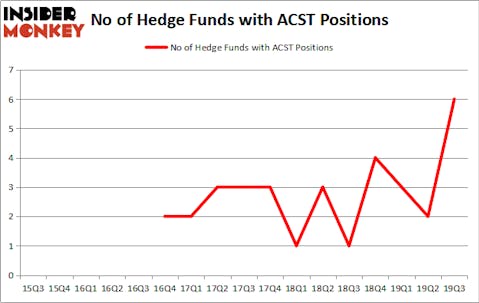

Acasti Pharma Inc. (NASDAQ:ACST) was in 6 hedge funds’ portfolios at the end of September. ACST shareholders have witnessed an increase in activity from the world’s largest hedge funds lately. There were 2 hedge funds in our database with ACST holdings at the end of the previous quarter. Our calculations also showed that ACST isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most investors, hedge funds are viewed as worthless, outdated investment tools of years past. While there are greater than 8000 funds in operation today, Our researchers look at the upper echelon of this group, about 750 funds. These hedge fund managers direct the majority of all hedge funds’ total asset base, and by keeping track of their inimitable investments, Insider Monkey has discovered various investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

William Harnisch of Peconic Partners LLC

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Keeping this in mind let’s take a look at the new hedge fund action encompassing Acasti Pharma Inc. (NASDAQ:ACST).

What does smart money think about Acasti Pharma Inc. (NASDAQ:ACST)?

Heading into the fourth quarter of 2019, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a change of 200% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards ACST over the last 17 quarters. With the smart money’s sentiment swirling, there exists a select group of notable hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Perceptive Advisors, managed by Joseph Edelman, holds the biggest position in Acasti Pharma Inc. (NASDAQ:ACST). Perceptive Advisors has a $3.4 million position in the stock, comprising 0.1% of its 13F portfolio. Sitting at the No. 2 spot is Peconic Partners, managed by William Harnisch, which holds a $0.7 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Some other professional money managers with similar optimism comprise John Overdeck and David Siegel’s Two Sigma Advisors, Renaissance Technologies and Ken Griffin’s Citadel Investment Group. In terms of the portfolio weights assigned to each position Peconic Partners allocated the biggest weight to Acasti Pharma Inc. (NASDAQ:ACST), around 0.15% of its 13F portfolio. Perceptive Advisors is also relatively very bullish on the stock, earmarking 0.09 percent of its 13F equity portfolio to ACST.

Consequently, some big names were breaking ground themselves. Peconic Partners, managed by William Harnisch, assembled the most outsized position in Acasti Pharma Inc. (NASDAQ:ACST). Peconic Partners had $0.7 million invested in the company at the end of the quarter. John Overdeck and David Siegel’s Two Sigma Advisors also initiated a $0.6 million position during the quarter. The following funds were also among the new ACST investors: Renaissance Technologies, Ken Griffin’s Citadel Investment Group, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s check out hedge fund activity in other stocks similar to Acasti Pharma Inc. (NASDAQ:ACST). These stocks are Horizon Technology Finance Corp (NASDAQ:HRZN), Nature’s Sunshine Prod. (NASDAQ:NATR), Plymouth Industrial REIT, Inc. (NYSEAMERICAN:PLYM), and Bassett Furniture Industries Inc. (NASDAQ:BSET). This group of stocks’ market values match ACST’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HRZN | 4 | 2022 | 3 |

| NATR | 6 | 65705 | 0 |

| PLYM | 7 | 16015 | 5 |

| BSET | 9 | 28847 | 0 |

| Average | 6.5 | 28147 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.5 hedge funds with bullish positions and the average amount invested in these stocks was $28 million. That figure was $5 million in ACST’s case. Bassett Furniture Industries Inc. (NASDAQ:BSET) is the most popular stock in this table. On the other hand Horizon Technology Finance Corp (NASDAQ:HRZN) is the least popular one with only 4 bullish hedge fund positions. Acasti Pharma Inc. (NASDAQ:ACST) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately ACST wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); ACST investors were disappointed as the stock returned 5.3% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.