We are still in an overall bull market and many stocks that smart money investors were piling into surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Hedge funds’ top 3 stock picks returned 41.7% this year and beat the S&P 500 ETFs by 14 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like UniFirst Corp (NYSE:UNF).

Hedge fund interest in UniFirst Corp (NYSE:UNF) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Corelogic Inc (NYSE:CLGX), Coherent, Inc. (NASDAQ:COHR), and Dicks Sporting Goods Inc (NYSE:DKS) to gather more data points. Our calculations also showed that UNF isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most investors, hedge funds are seen as unimportant, outdated investment vehicles of years past. While there are greater than 8000 funds trading at the moment, Our experts hone in on the top tier of this club, about 750 funds. These money managers oversee the majority of the smart money’s total asset base, and by monitoring their highest performing investments, Insider Monkey has determined several investment strategies that have historically outperformed the broader indices. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Clint Carlson of Carlson Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to review the recent hedge fund action encompassing UniFirst Corp (NYSE:UNF).

What does smart money think about UniFirst Corp (NYSE:UNF)?

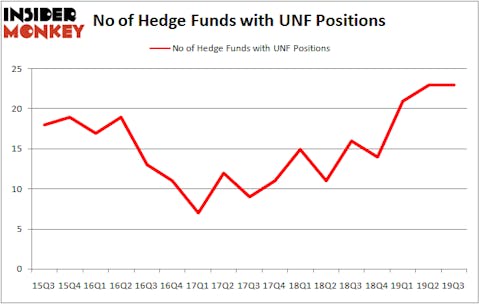

At Q3’s end, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the second quarter of 2019. By comparison, 16 hedge funds held shares or bullish call options in UNF a year ago. With the smart money’s sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

The largest stake in UniFirst Corp (NYSE:UNF) was held by Carlson Capital, which reported holding $29.8 million worth of stock at the end of September. It was followed by GLG Partners with a $26.9 million position. Other investors bullish on the company included Echo Street Capital Management, Royce & Associates, and Citadel Investment Group. In terms of the portfolio weights assigned to each position One Fin Capital Management allocated the biggest weight to UniFirst Corp (NYSE:UNF), around 3.75% of its 13F portfolio. Lunia Capital is also relatively very bullish on the stock, earmarking 2.86 percent of its 13F equity portfolio to UNF.

Judging by the fact that UniFirst Corp (NYSE:UNF) has witnessed declining sentiment from hedge fund managers, it’s easy to see that there lies a certain “tier” of hedgies that slashed their entire stakes in the third quarter. At the top of the heap, Guy Shahar’s DSAM Partners said goodbye to the largest stake of the “upper crust” of funds followed by Insider Monkey, totaling an estimated $4 million in stock, and Mark Broach’s Manatuck Hill Partners was right behind this move, as the fund said goodbye to about $1.5 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to UniFirst Corp (NYSE:UNF). We will take a look at Corelogic Inc (NYSE:CLGX), Coherent, Inc. (NASDAQ:COHR), Dicks Sporting Goods Inc (NYSE:DKS), and Chimera Investment Corporation (NYSE:CIM). This group of stocks’ market valuations are similar to UNF’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CLGX | 28 | 370528 | 5 |

| COHR | 17 | 227281 | -2 |

| DKS | 25 | 472598 | 2 |

| CIM | 12 | 132694 | -1 |

| Average | 20.5 | 300775 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $301 million. That figure was $195 million in UNF’s case. Corelogic Inc (NYSE:CLGX) is the most popular stock in this table. On the other hand Chimera Investment Corporation (NYSE:CIM) is the least popular one with only 12 bullish hedge fund positions. UniFirst Corp (NYSE:UNF) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately UNF wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on UNF were disappointed as the stock returned 5.7% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.