Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we publish an article with the title “Recession is Imminent: We Need A Travel Ban NOW”. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. We at Insider Monkey have gone over 835 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article, we look at what those funds think of Twitter Inc (NYSE:TWTR) based on that data.

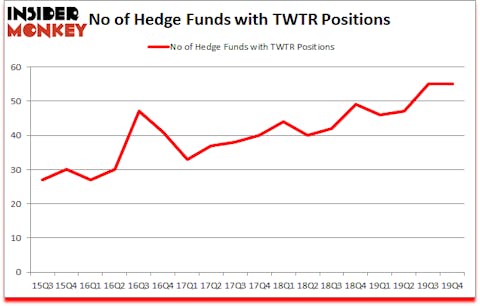

Twitter Inc (NYSE:TWTR) shares haven’t seen a lot of action during the fourth quarter. Overall, hedge fund sentiment stood at its all time high. The stock was in 55 hedge funds’ portfolios at the end of the fourth quarter of 2019. At the end of this article we will also compare TWTR to other stocks including KKR & Co Inc. (NYSE:KKR), Xilinx, Inc. (NASDAQ:XLNX), and Verisk Analytics, Inc. (NASDAQ:VRSK) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Philippe Laffont of Coatue Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. Now we’re going to review the new hedge fund action regarding Twitter Inc (NYSE:TWTR).

What does smart money think about Twitter Inc (NYSE:TWTR)?

At the end of the fourth quarter, a total of 55 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in TWTR over the last 18 quarters. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

More specifically, Coatue Management was the largest shareholder of Twitter Inc (NYSE:TWTR), with a stake worth $624.1 million reported as of the end of September. Trailing Coatue Management was Citadel Investment Group, which amassed a stake valued at $185.7 million. D E Shaw, Tremblant Capital, and AQR Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position ThornTree Capital Partners allocated the biggest weight to Twitter Inc (NYSE:TWTR), around 11.2% of its 13F portfolio. Kayak Investment Partners is also relatively very bullish on the stock, designating 9.53 percent of its 13F equity portfolio to TWTR.

Judging by the fact that Twitter Inc (NYSE:TWTR) has faced a decline in interest from the smart money, it’s easy to see that there lies a certain “tier” of hedge funds that elected to cut their entire stakes heading into Q4. Interestingly, Renaissance Technologies sold off the biggest stake of all the hedgies followed by Insider Monkey, valued at an estimated $240.6 million in stock. Panayotis Takis Sparaggis’s fund, Alkeon Capital Management, also dumped its stock, about $143.2 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Twitter Inc (NYSE:TWTR). These stocks are KKR & Co Inc. (NYSE:KKR), Xilinx, Inc. (NASDAQ:XLNX), Verisk Analytics, Inc. (NASDAQ:VRSK), and Aptiv PLC (NYSE:APTV). All of these stocks’ market caps resemble TWTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KKR | 56 | 3623655 | 13 |

| XLNX | 42 | 1025915 | -1 |

| VRSK | 33 | 848898 | -1 |

| APTV | 46 | 1053189 | 17 |

| Average | 44.25 | 1637914 | 7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 44.25 hedge funds with bullish positions and the average amount invested in these stocks was $1638 million. That figure was $1427 million in TWTR’s case. KKR & Co Inc. (NYSE:KKR) is the most popular stock in this table. On the other hand Verisk Analytics, Inc. (NASDAQ:VRSK) is the least popular one with only 33 bullish hedge fund positions. Twitter Inc (NYSE:TWTR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 12.9% in 2020 through March 9th but still beat the market by 1.9 percentage points. Hedge funds were also right about betting on TWTR as the stock returned 1.3% during the first quarter (through March 9th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.