Is TTEC Holdings, Inc. (NASDAQ:TTEC) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

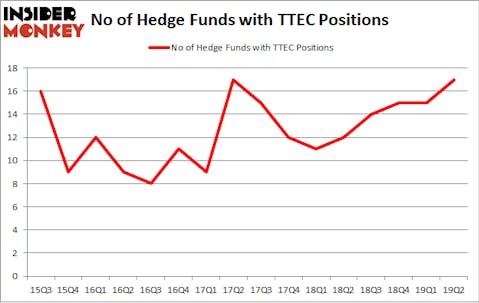

TTEC Holdings, Inc. (NASDAQ:TTEC) investors should pay attention to an increase in activity from the world’s largest hedge funds of late. TTEC was in 17 hedge funds’ portfolios at the end of June. There were 15 hedge funds in our database with TTEC holdings at the end of the previous quarter. Our calculations also showed that TTEC isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are tons of gauges stock market investors use to value stocks. Two of the most useful gauges are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the elite investment managers can outpace the broader indices by a solid amount (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s check out the latest hedge fund action surrounding TTEC Holdings, Inc. (NASDAQ:TTEC).

What have hedge funds been doing with TTEC Holdings, Inc. (NASDAQ:TTEC)?

Heading into the third quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from the previous quarter. The graph below displays the number of hedge funds with bullish position in TTEC over the last 16 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in TTEC Holdings, Inc. (NASDAQ:TTEC), which was worth $18.1 million at the end of the second quarter. On the second spot was Shannon River Fund Management which amassed $8.7 million worth of shares. Moreover, Arrowstreet Capital, Citadel Investment Group, and PEAK6 Capital Management were also bullish on TTEC Holdings, Inc. (NASDAQ:TTEC), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers were breaking ground themselves. Shannon River Fund Management, managed by Spencer M. Waxman, assembled the largest position in TTEC Holdings, Inc. (NASDAQ:TTEC). Shannon River Fund Management had $8.7 million invested in the company at the end of the quarter. Minhua Zhang’s Weld Capital Management also initiated a $0.5 million position during the quarter. The other funds with new positions in the stock are Mike Vranos’s Ellington and David Harding’s Winton Capital Management.

Let’s also examine hedge fund activity in other stocks similar to TTEC Holdings, Inc. (NASDAQ:TTEC). These stocks are OSI Systems, Inc. (NASDAQ:OSIS), Verra Mobility Corporation (NASDAQ:VRRM), Sanmina Corporation (NASDAQ:SANM), and Otter Tail Corporation (NASDAQ:OTTR). This group of stocks’ market values are similar to TTEC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OSIS | 13 | 65185 | 3 |

| VRRM | 21 | 173954 | 7 |

| SANM | 18 | 193604 | 0 |

| OTTR | 12 | 77316 | 2 |

| Average | 16 | 127515 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $128 million. That figure was $43 million in TTEC’s case. Verra Mobility Corporation (NASDAQ:VRRM) is the most popular stock in this table. On the other hand Otter Tail Corporation (NASDAQ:OTTR) is the least popular one with only 12 bullish hedge fund positions. TTEC Holdings, Inc. (NASDAQ:TTEC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on TTEC, though not to the same extent, as the stock returned 3.5% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.