Is TransUnion (NYSE:TRU) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

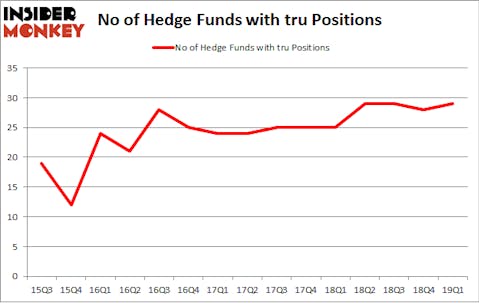

TransUnion (NYSE:TRU) was in 29 hedge funds’ portfolios at the end of March. TRU has seen an increase in activity from the world’s largest hedge funds recently. There were 28 hedge funds in our database with TRU positions at the end of the previous quarter. Our calculations also showed that tru isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to view the latest hedge fund action regarding TransUnion (NYSE:TRU).

What does the smart money think about TransUnion (NYSE:TRU)?

Heading into the second quarter of 2019, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of 4% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards TRU over the last 15 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of key hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

More specifically, Lone Pine Capital was the largest shareholder of TransUnion (NYSE:TRU), with a stake worth $430.1 million reported as of the end of March. Trailing Lone Pine Capital was Farallon Capital, which amassed a stake valued at $288.6 million. Egerton Capital Limited, Citadel Investment Group, and Marshall Wace LLP were also very fond of the stock, giving the stock large weights in their portfolios.

Now, some big names have been driving this bullishness. Citadel Investment Group, managed by Ken Griffin, created the biggest position in TransUnion (NYSE:TRU). Citadel Investment Group had $131.4 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $87.4 million investment in the stock during the quarter. The following funds were also among the new TRU investors: James Parsons’s Junto Capital Management, Robert Pohly’s Samlyn Capital, and Per Johanssoná’s Bodenholm Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as TransUnion (NYSE:TRU) but similarly valued. These stocks are Mid-America Apartment Communities, Inc. (NYSE:MAA), The Liberty SiriusXM Group (NASDAQ:LSXMA), The Liberty SiriusXM Group (NASDAQ:LSXMK), and Autohome Inc (NYSE:ATHM). This group of stocks’ market values are closest to TRU’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MAA | 21 | 355779 | 0 |

| LSXMA | 41 | 1344969 | 2 |

| LSXMK | 45 | 2653274 | 0 |

| ATHM | 16 | 1251641 | 2 |

| Average | 30.75 | 1401416 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.75 hedge funds with bullish positions and the average amount invested in these stocks was $1401 million. That figure was $1570 million in TRU’s case. The Liberty SiriusXM Group (NASDAQ:LSXMK) is the most popular stock in this table. On the other hand Autohome Inc (NYSE:ATHM) is the least popular one with only 16 bullish hedge fund positions. TransUnion (NYSE:TRU) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately TRU wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); TRU investors were disappointed as the stock returned -1.7% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.