How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding The Hanover Insurance Group, Inc. (NYSE:THG).

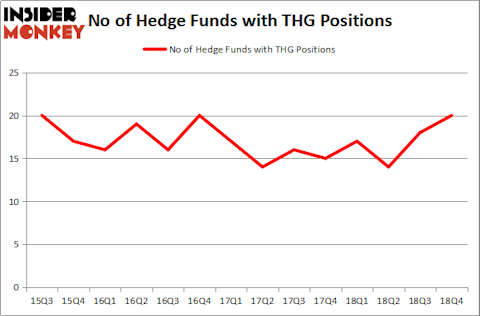

The Hanover Insurance Group, Inc. (NYSE:THG) investors should be aware of an increase in hedge fund sentiment lately. THG was in 20 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 18 hedge funds in our database with THG holdings at the end of the previous quarter. Our calculations also showed that THG isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a glance at the new hedge fund action regarding The Hanover Insurance Group, Inc. (NYSE:THG).

What does the smart money think about The Hanover Insurance Group, Inc. (NYSE:THG)?

At the end of the fourth quarter, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of 11% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards THG over the last 14 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the biggest position in The Hanover Insurance Group, Inc. (NYSE:THG). AQR Capital Management has a $76 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by Ken Griffin of Citadel Investment Group, with a $74.6 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining professional money managers that hold long positions include Jim Simons’s Renaissance Technologies, Richard S. Pzena’s Pzena Investment Management and Israel Englander’s Millennium Management.

As aggregate interest increased, key money managers have been driving this bullishness. Weld Capital Management, managed by Minhua Zhang, initiated the most outsized position in The Hanover Insurance Group, Inc. (NYSE:THG). Weld Capital Management had $1.1 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also made a $1.1 million investment in the stock during the quarter. The other funds with brand new THG positions are Michael Platt and William Reeves’s BlueCrest Capital Mgmt. and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now take a look at hedge fund activity in other stocks similar to The Hanover Insurance Group, Inc. (NYSE:THG). These stocks are Hexcel Corporation (NYSE:HXL), HubSpot Inc (NYSE:HUBS), Monolithic Power Systems, Inc. (NASDAQ:MPWR), and Coty Inc (NYSE:COTY). All of these stocks’ market caps match THG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HXL | 23 | 150545 | 0 |

| HUBS | 22 | 349232 | 1 |

| MPWR | 25 | 170884 | 7 |

| COTY | 19 | 132043 | -5 |

| Average | 22.25 | 200676 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $201 million. That figure was $368 million in THG’s case. Monolithic Power Systems, Inc. (NASDAQ:MPWR) is the most popular stock in this table. On the other hand Coty Inc (NYSE:COTY) is the least popular one with only 19 bullish hedge fund positions. The Hanover Insurance Group, Inc. (NYSE:THG) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were disappointed as THG returned 5% and underperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.